Accountant Resume Tips & Examples

Need a strong accountant resume for 2025? Discover top examples and strategies to showcase your expertise. Read our latest blog now!

October 31, 2024

The accounting industry continues to be a cornerstone of every successful business, with professionals ensuring financial accuracy, compliance, and strategic planning. As the demand for skilled accountants grows in 2025, so does the competition for top roles across public, private, and corporate sectors. Whether you’re a seasoned CPA or an entry-level applicant, your resume needs to do more than list credentials—it must make an impact and be ATS-friendly (applicant tracking system).

That’s where this blog comes in. We’ve curated a collection of standout accountant resume examples tailored for 2025, along with expert tips to help you write a resume that gets noticed. Ready to land more interviews? Let’s build a resume that works as hard as you do.

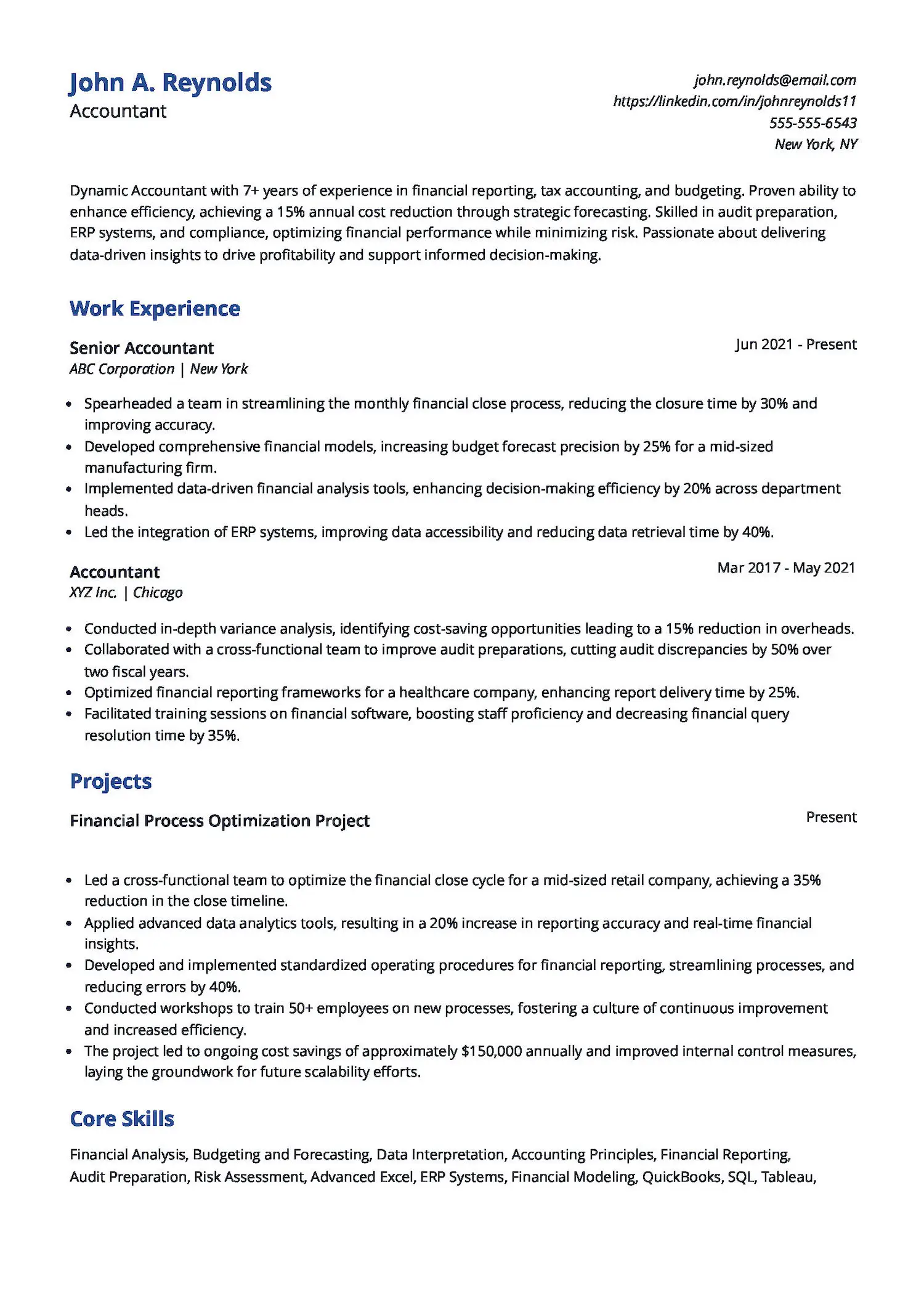

Accountant resume example

Looking for a standout resume that will help you advance your accounting career and make an impact? You have come to the right place! This senior accountant resume example highlights expertise in financial forecasting, audit preparation, and ERP systems, along with key achievements like reducing closure times and improving reporting accuracy.

A senior accountant is expected to lead financial processes, ensure compliance, and provide data-driven insights. Strong problem-solving skills, technical proficiency, and the ability to collaborate across teams are essential. Your resume should showcase experience in financial modeling, risk assessment, and system integration to stand out in this competitive field.

With a results-driven profile showcasing quantifiable achievements—cutting financial close time by 30% and saving $150,000 annually—this resume speaks the language of hiring managers and ATS alike. Rich in relevant keywords like “ERP systems,” “financial modeling,” and “audit preparation,” it’s perfectly optimized for keyword scanning.

The clear structure, strong action verbs, and industry-specific skills ensure it rises to the top of the pile, instantly proving value to decision-makers.

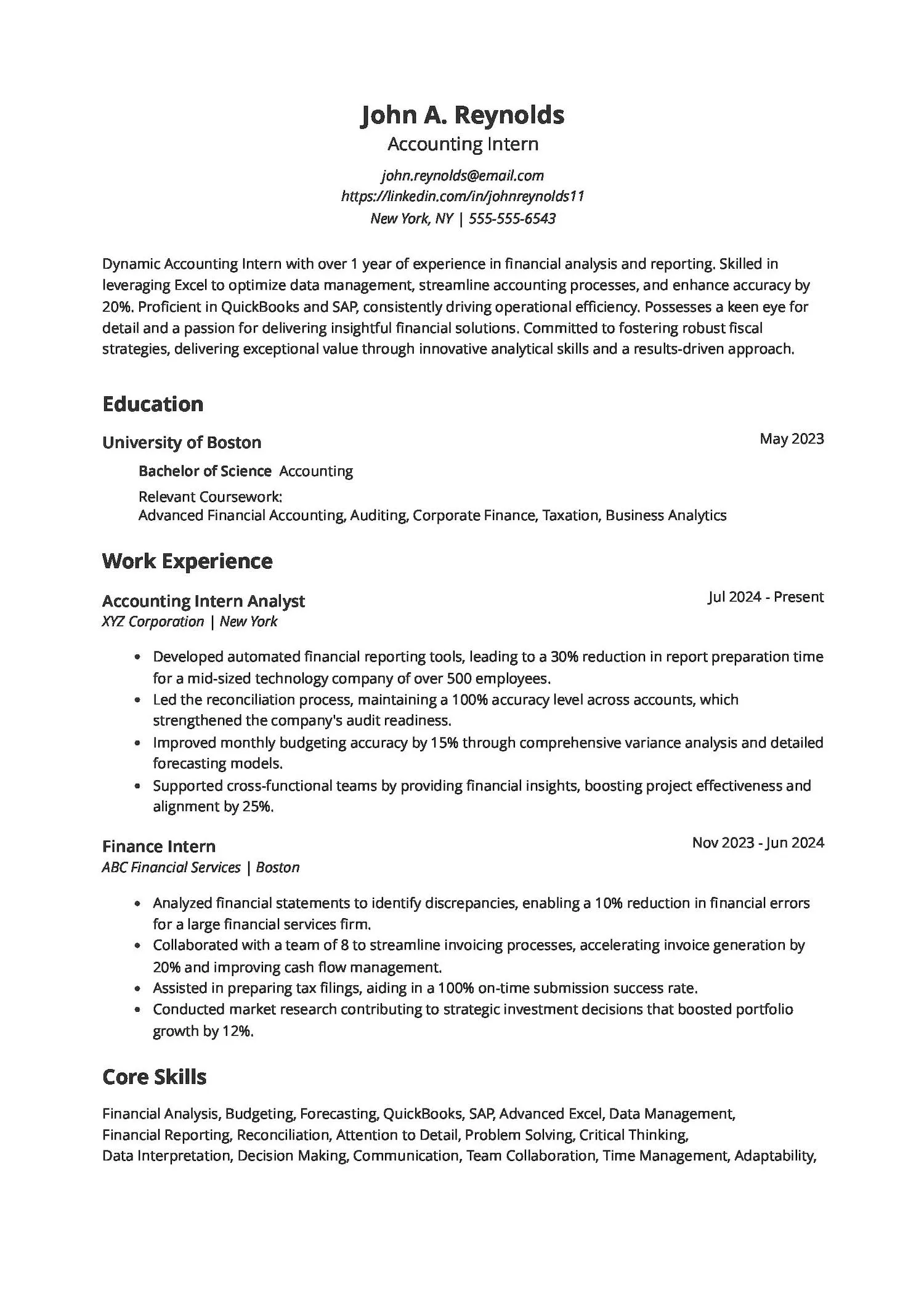

Accounting intern resume example

Feeling the pressure to make your accounting internship application shine? It’s tough to show your potential with limited experience, right? Here is an example resume that will walk you through the elements of a strong resume for an intern role, discussing the skills, knowledge, and key accomplishments that will make your resume stand out to potential employers.

An accounting intern supports financial operations by assisting with reporting, reconciliation, and data analysis. Companies seek detail-oriented individuals with strong problem-solving skills, adaptability, and the ability to work with cross-functional teams. To make a strong impression, your resume should showcase technical proficiency, analytical thinking, and a results-driven approach.

Writing an impressive intern resume without years of experience is no easy feat, yet this one hits the mark with impact and precision. The work experience section highlights measurable achievements, like reducing report prep time by 30% and boosting budgeting accuracy by 15%, proving real-world value.

Meanwhile, the core skills section is rich with ATS-friendly keywords such as “QuickBooks,” “Reconciliation,” and “Operational Efficiency,” ensuring it ranks high in recruiter searches while showcasing a well-rounded, capable candidate ready to deliver.

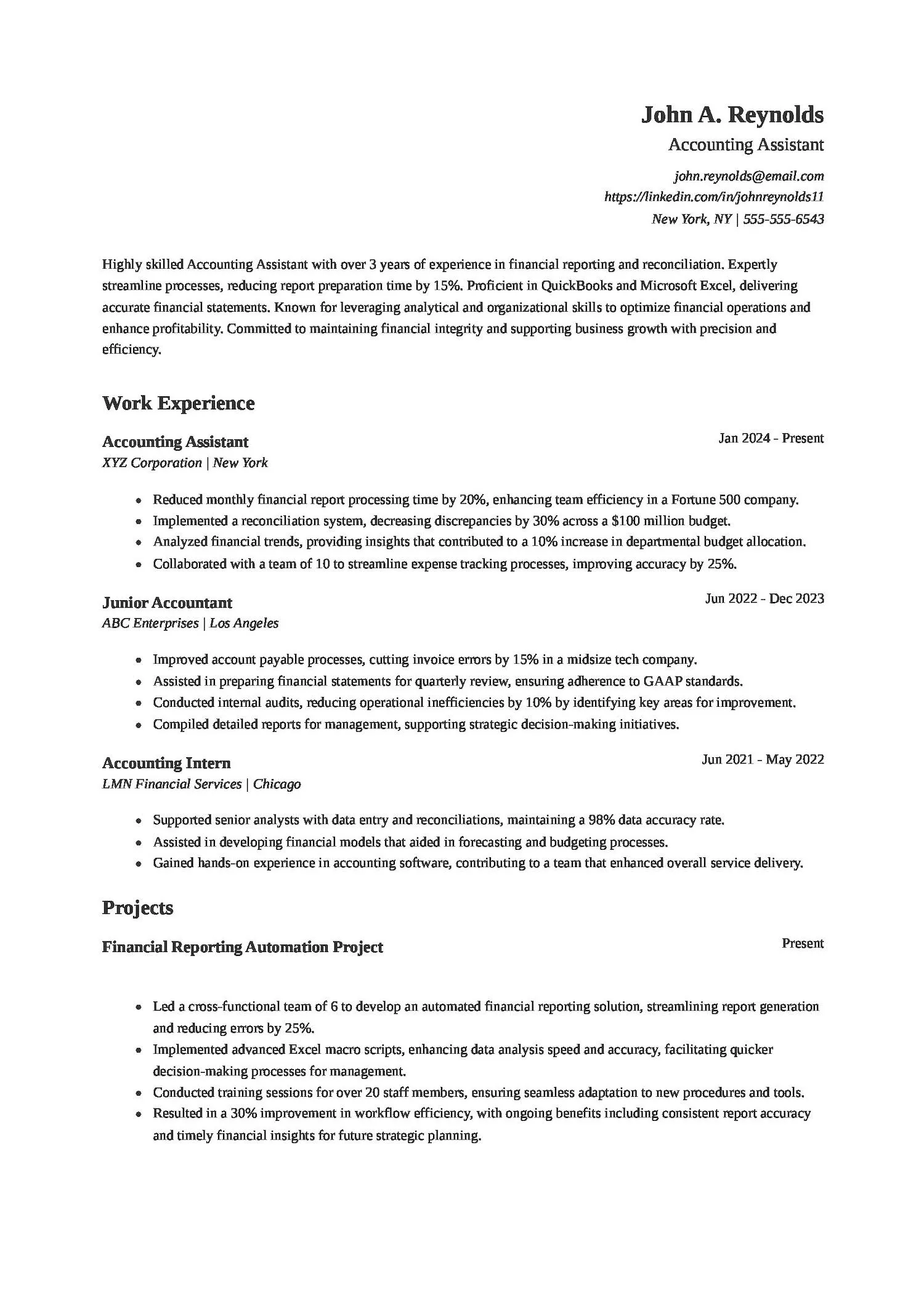

Accounting assistant resume example

Ready to land that accounting assistant role? Take inspiration from our template resume. This accounting assistant resume example highlights how to demonstrate expertise in QuickBooks, Excel, and budget management, along with achievements like reducing report preparation time and improving accuracy.

Accounting assistants are the backbone of smooth financial operations. Employers need someone who excels in reporting, reconciliation, and compliance, all while bringing strong analytical and problem-solving skills to the table. Your resume should reflect technical proficiency, attention to detail, and the ability to contribute to business efficiency. Show them you’re the one who can keep their books in perfect order.

Are you struggling to show growth, skills, and value in an accounting assistant resume? This example does it all. The professional summary instantly conveys impact, highlighting efficiency, precision, and software expertise and setting a confident tone.

On the other hand, the education section is clear, strategic, and layered. It showcases both a bachelor’s and an associate degree, along with honors that validate academic excellence. It’s an ideal blueprint for job seekers aiming to balance experience, skills, and credibility in a format that’s both recruiter—and ATS-friendly.

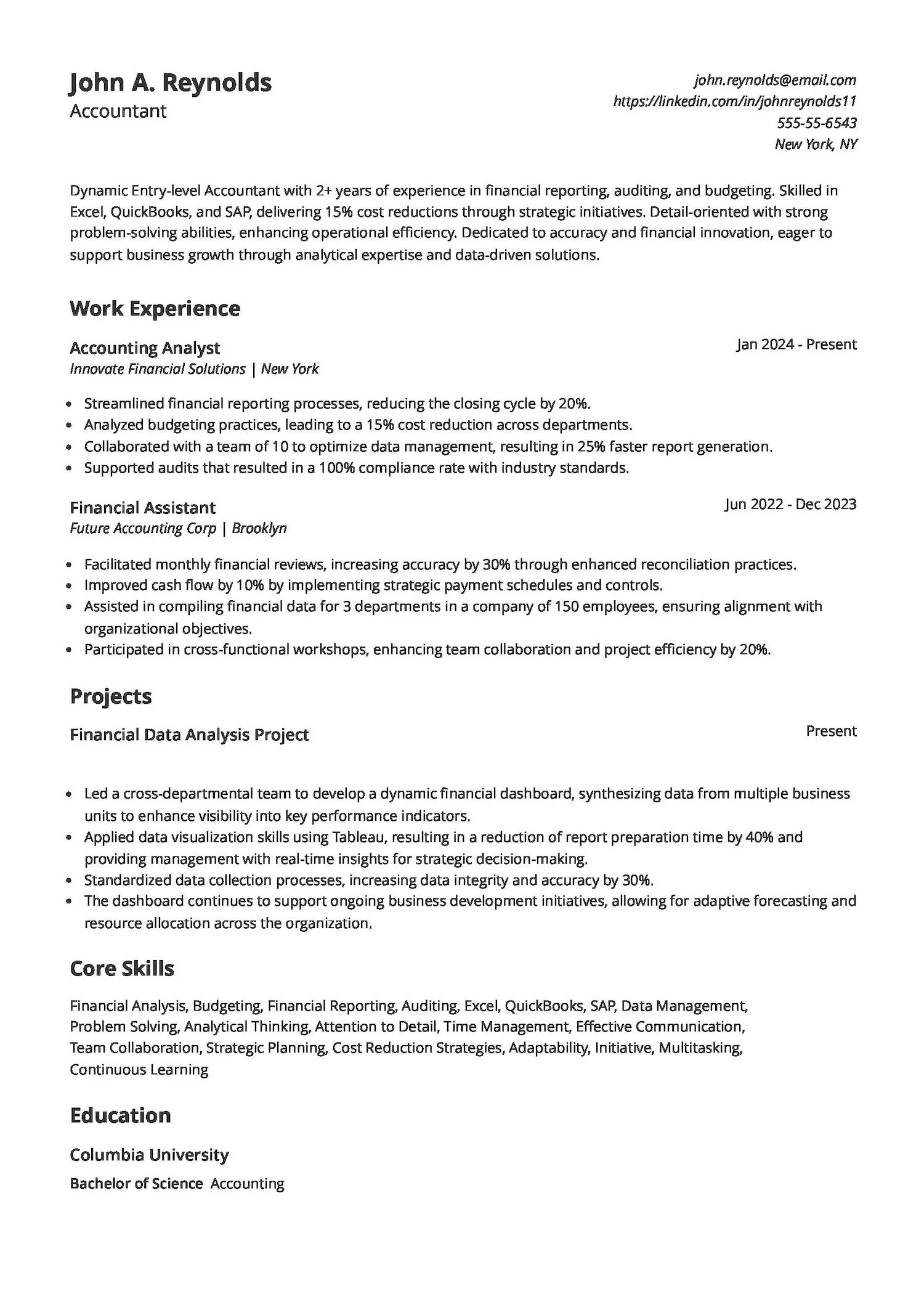

Entry-level accountant resume example

Looking to land your first accounting job or take the next step in your career? Wondering how to highlight your financial reporting, budgeting, and auditing skills to stand out? Here is an entry-level accountant resume example to help you. Learn how to showcase your expertise in Excel, QuickBooks, and SAP, along with key achievements like cost reduction and financial process optimization.

An entry-level accountant requires accuracy, problem-solving skills, and expertise in financial analysis. Employers expect candidates to manage financial data, assist with audits, and support budgeting processes while ensuring compliance with industry standards. Your resume should highlight technical skills, attention to detail, and the ability to work collaboratively to drive efficiency and business growth.

When a resume combines impact-driven projects with ATS-optimized skills, it’s bound to stand out—and this one does just that. The Financial Data Analytics project showcases real-world initiative, leadership, and a 40% boost in reporting speed, instantly proving value.

Meanwhile, the core skills section is rich in relevant, searchable terms like “SAP,” “Auditing,” “Cost Reduction Strategies,” and “Data Management,” ensuring it checks every box for both hiring managers and automated systems. It’s the perfect blend of performance and precision.

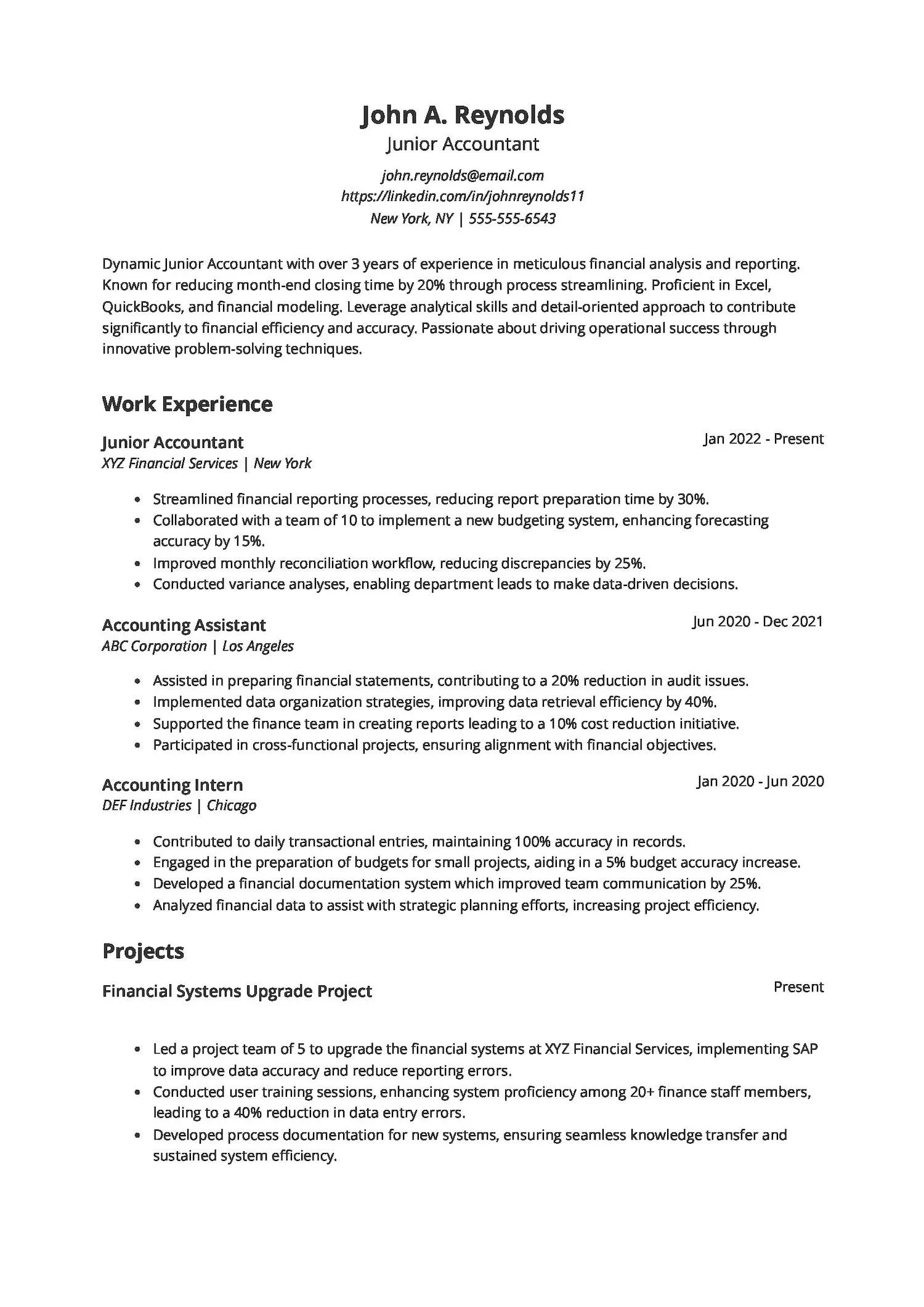

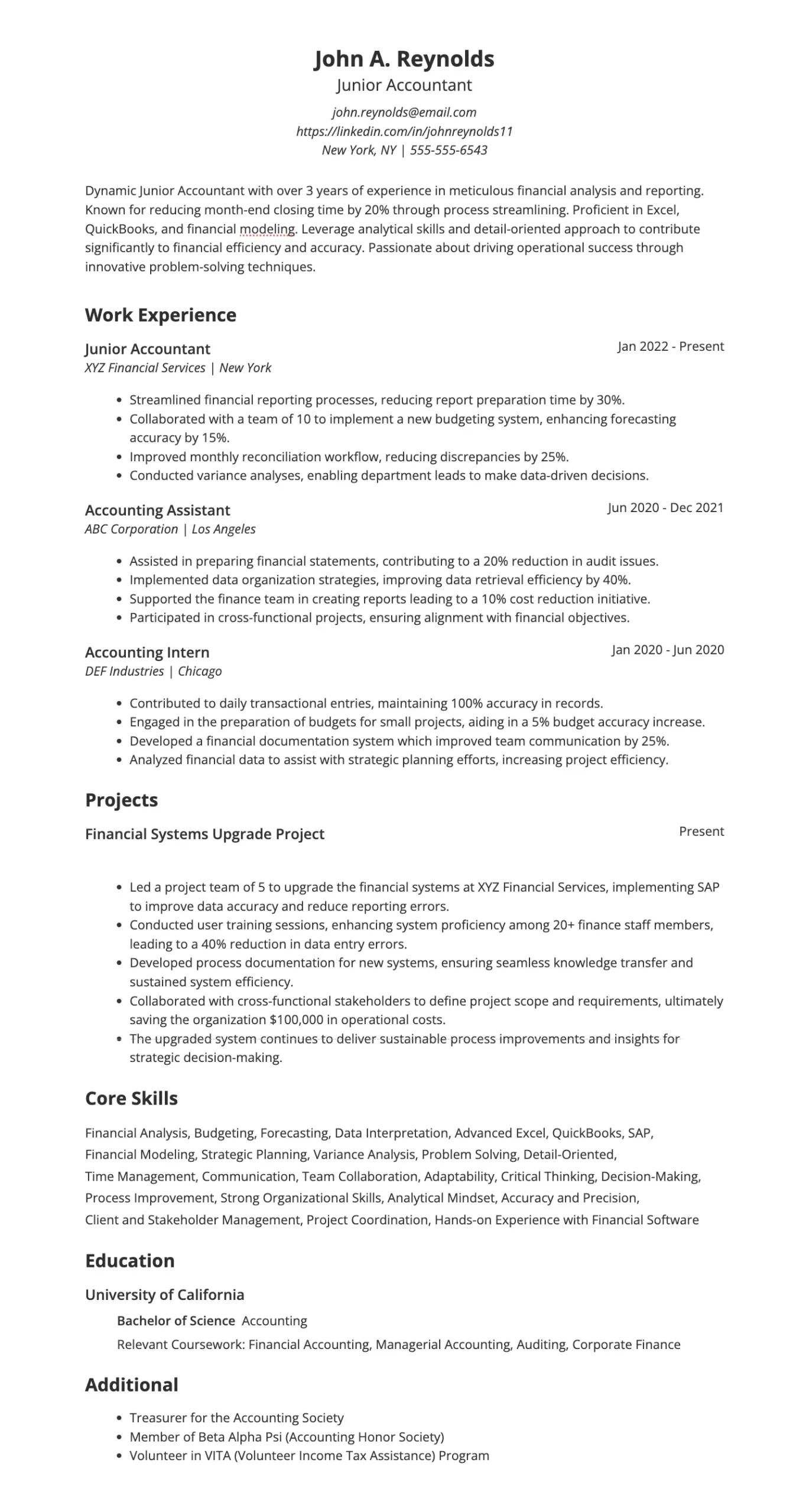

Junior accountant resume example

Feeling stuck on how to showcase your Junior Accountant skills? Are you wondering how to prove you can deliver results beyond basic tasks? Take a close look at John A. Reynolds’ resume. It’s a great example of how to highlight your impact and potential in the accounting field.

For a Junior Accountant role, employers seek candidates who can demonstrate a strong foundation in financial analysis, reporting, and process improvement. They’re looking for individuals who are proficient in tools like Excel and QuickBooks, and who can contribute to efficiency and accuracy. Candidates are expected to show they’re detail-oriented, analytical, and capable of working collaboratively. Show your ability to streamline processes and drive data-driven decisions.

The resume’s work history shows consistent impact—from slashing reporting time by 30% to saving $100,000 through a systems upgrade. Each role adds tangible value, showcasing a candidate who doesn’t just complete tasks but improves processes and drives results.

This momentum is reinforced by a strong academic foundation, with relevant coursework in auditing, corporate finance, and accounting. Leadership roles—such as Treasurer of the Accounting Society and volunteer in the VITA program—underscore initiative, reliability, and a service-oriented mindset. Combined with keyword-rich content and industry-relevant skills, this resume is built to make a lasting impact.

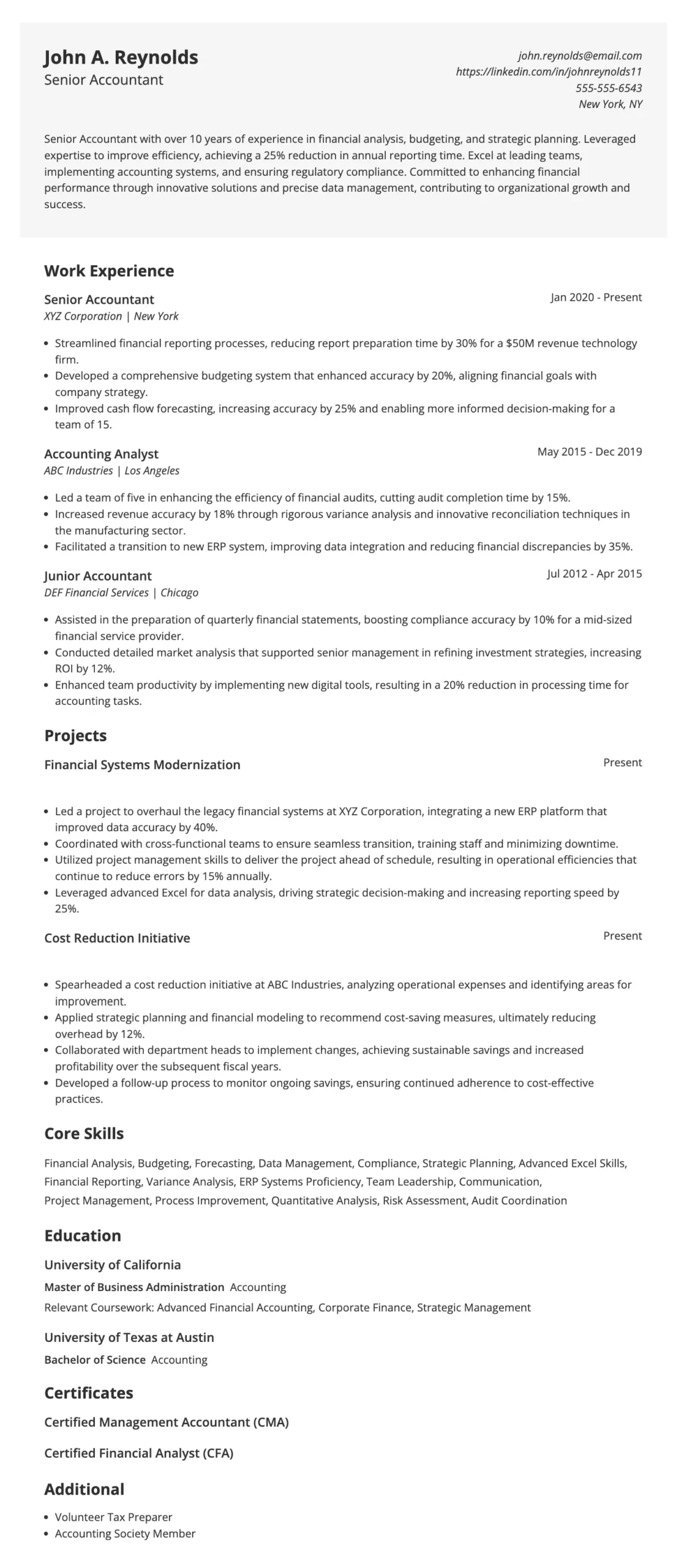

Senior accountant resume example

Aiming for a senior accountant role? A well-structured resume that highlights key skills and achievements can set you apart. Below is a senior accountant resume example that will help you understand how to showcase your expertise in financial reporting, ERP systems, and cost reduction strategies effectively.

A senior accountant resume should emphasize experience in financial analysis, budgeting, forecasting, and audit coordination while demonstrating leadership and process optimization skills. Employers expect candidates to develop financial reports, identify cost-saving opportunities, and improve accounting workflows. Make sure your resume includes measurable accomplishments that showcase your ability to enhance economic efficiency and decision-making.

Driving results through strategy and skill, this resume highlights complex, high-impact projects, like a financial systems modernization that improved data accuracy by 40% and a cost reduction initiative that cut overhead by 12%. The candidate’s advanced credentials, including CMA and CFA certifications, signal deep financial acumen.

With an MBA from UC Berkeley and a strong academic track record, this resume is both ATS-optimized and tailored to impress recruiters seeking leadership, innovation, and measurable success in accounting.

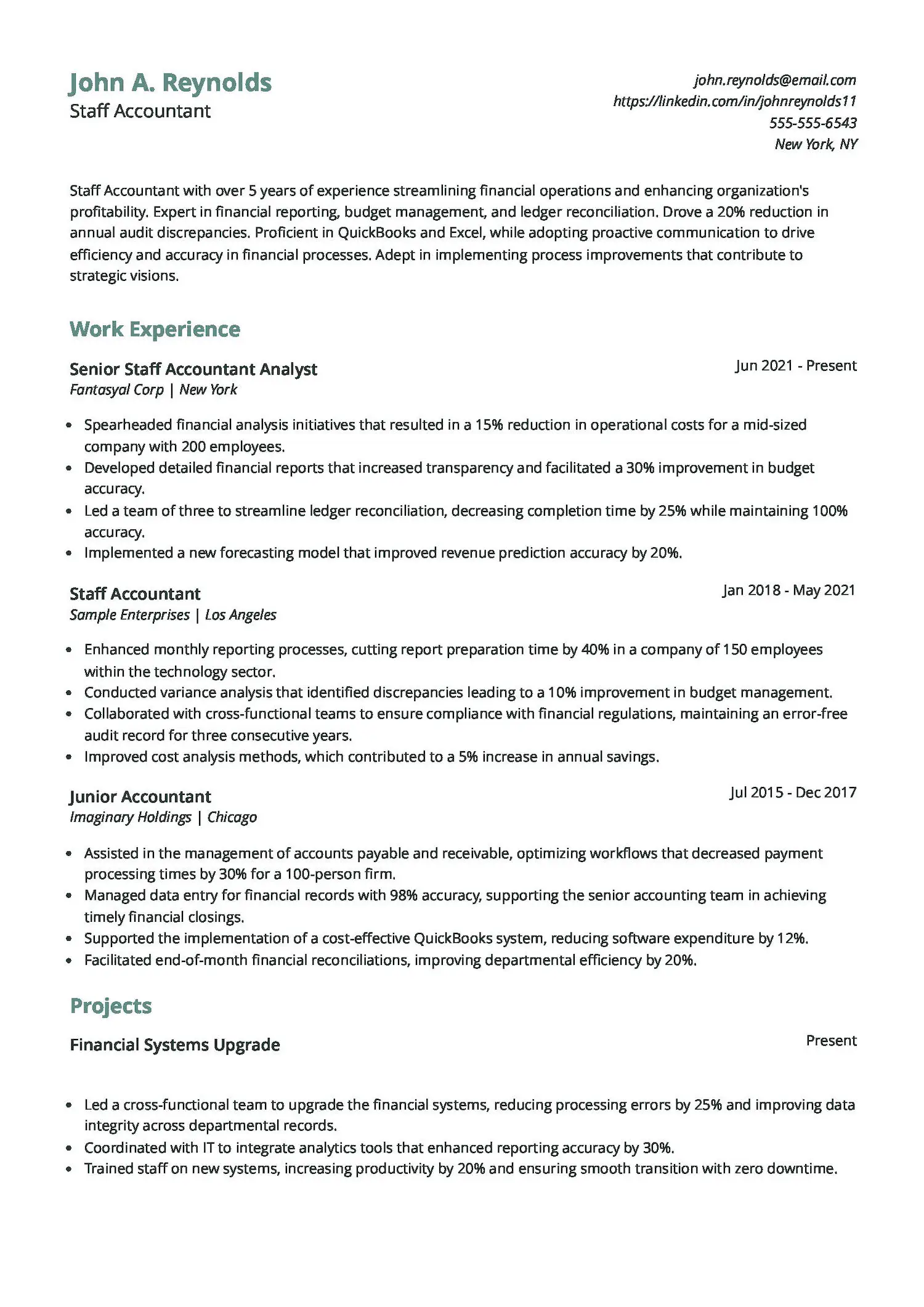

Staff accountant resume example

Are you looking for a standout Staff Accountant resume? Take inspiration from our resume example and learn how to showcase your financial reporting, budgeting, and ledger reconciliation expertise.

Employers seek more than just technical skills for a staff accountant role. John’s resume highlights key components such as financial reporting, budget management, and process improvement. Candidates should showcase their ability to streamline operations, reduce discrepancies, and drive efficiency. Expect to demonstrate proficiency in financial software, strong analytical skills, and a proactive approach to problem-solving.

This resume’s professional summary immediately signals measurable impact and technical depth, as it reduces audit discrepancies by 20% and drives a 15% cut in operational costs. The projects section further elevates appeal, as it leads a financial systems upgrade that slashed errors by 25% and a budget optimization initiative that delivers 10% annual savings.

With clear, quantified outcomes and leadership in strategic initiatives, the resume grabs recruiters’ attention by showcasing a results-driven accountant poised to enhance financial operations from day one.

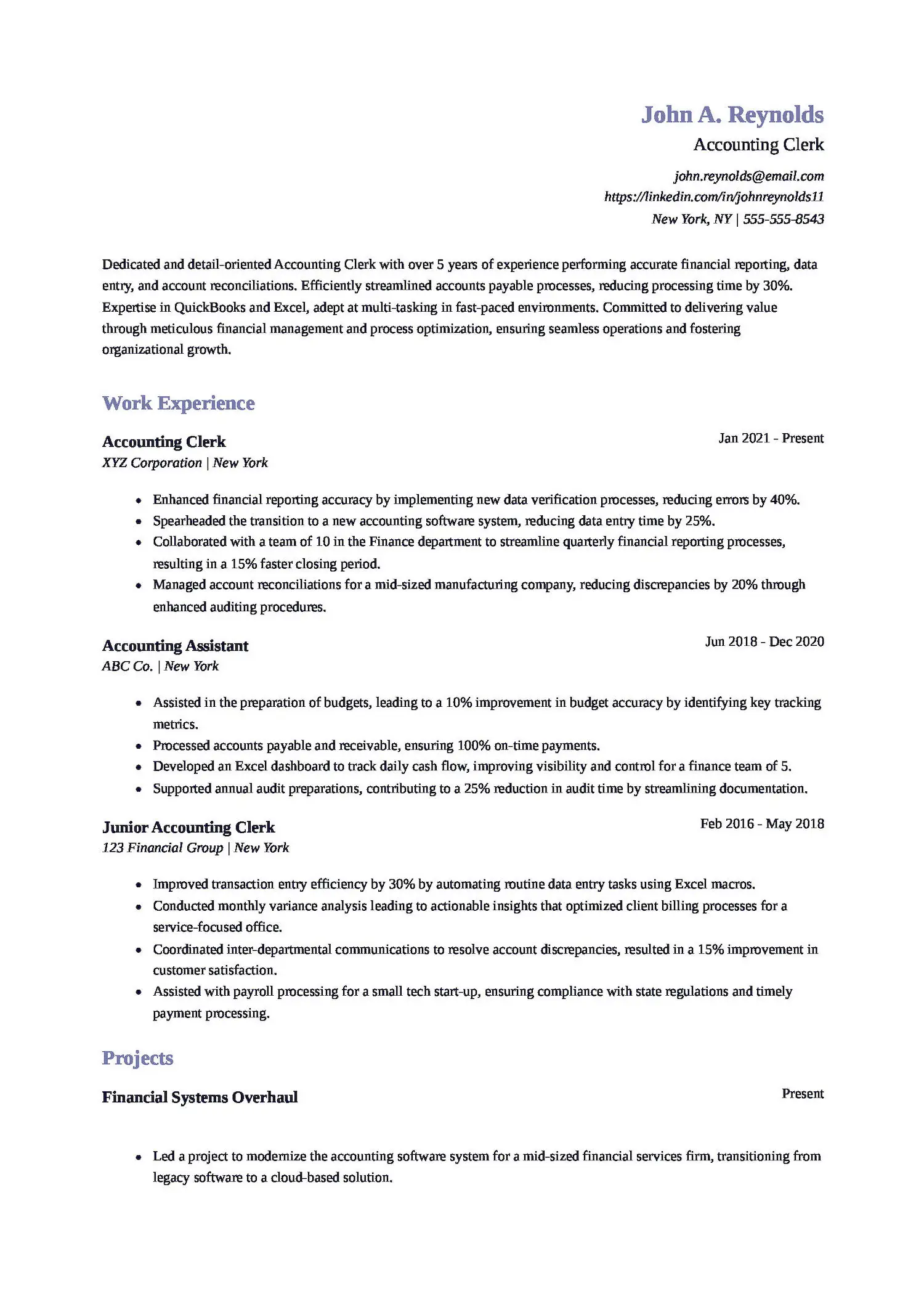

Accounting clerk resume example

Feeling the pressure to make your Accounting Clerk resume stand out? You’re looking to prove you’re more than just numbers, right? Check out the resume below—it’s a great example of how to showcase your financial expertise and impact.

To shine as an Accounting Clerk, show your proficiency in software like QuickBooks and Excel, highlight your ability to streamline processes, and quantify your impact with clear metrics. Employers expect detail-oriented, adaptable candidates who can contribute to financial accuracy and operational efficiency.

Packed with in-demand skills like financial reporting, QuickBooks, Excel, and process optimization, the core skills section showcases a well-rounded professional equipped to thrive in any accounting team.

Combined with a strong academic track record—evidenced by Dean’s List honors and an Academic Excellence Award—this resume paints a picture of a high-performing candidate with both technical precision and a commitment to excellence. It immediately signals reliability, adaptability, and value, making it a standout for any recruiter or hiring manager.

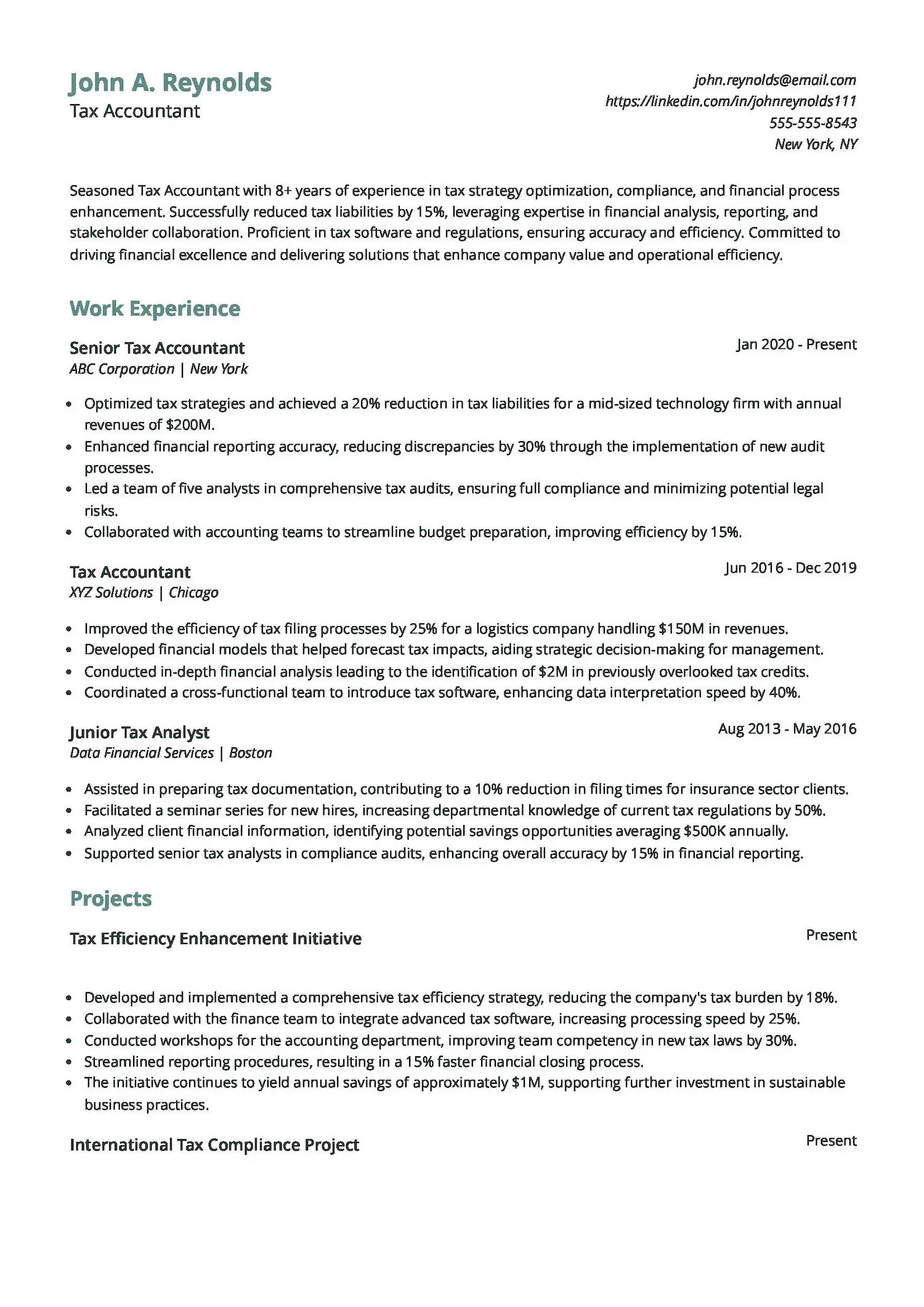

Tax accountant resume example

Landing a job as a Tax Accountant requires more than just number-crunching—you need to showcase your expertise in tax compliance, financial analysis, and strategic planning in a way that stands out to employers. A well-structured resume can make all the difference. Check out this resume example to see how to highlight your skills, achievements, and industry knowledge effectively.

A strong Tax Accountant resume should emphasize tax strategy optimization, regulatory compliance, audit preparation, and financial reporting. Employers look for candidates who can minimize liabilities, ensure accuracy, and improve processes while staying up to date with changing tax laws. Your resume should reflect key accomplishments, software proficiency, and the ability to collaborate with stakeholders to drive financial success.

With a proven track record of reducing tax liabilities by up to 20% and uncovering $2M in overlooked credits, this resume highlights a results-driven tax professional who blends technical expertise with strategic impact. The candidate’s hands-on leadership in major tax projects and advanced education from top-tier institutions underscores capability and credibility.

Awards and honors like Magna Cum Laude and the Outstanding Finance Student Award further cement the candidate’s status as a high-caliber hire poised to elevate any finance team.

How to write an accountant resume that will get you an interview

If you want your accountant resume to stand out and land you an interview, you need to understand how applicant tracking systems (ATS) work. ATS is the search engine recruiters use to find applicants before it even reaches a hiring team. Instead of manually reviewing every resume, hiring managers rely on ATS to organize candidates based on keywords, job titles, and relevant skills.

Let’s understand the whole process:

- When you submit your resume, it gets scanned and stored in a searchable database.

- Recruiters search the ATS for information like job title, skills required, qualifications, etc.

- When a recruiter searches for specific qualifications, only resumes containing those keywords appear in the results.

If your resume lacks the right keywords, it stays hidden, no matter how qualified you are.

To ensure your resume ranks high in ATS searches, leverage Jobscan’s Free resume builder. With this tool, you can create a well-structured, keyword-optimized resume that increases your chances of being found in the ATS database. Unlike flashy designs that may get rejected, Jobscan prioritizes content and formatting that hiring managers can easily review. Start using Jobscan’s Free Resume Builder today!

Optimize your resume

Use Jobscan's resume scanner to ensure your accountant resume is ATS-friendly and includes all the necessary keywords from the job description.

Scan your resume

Key elements of an accountant resume

A strong accountant resume should highlight your skills, experience, and certifications while ensuring it is ATS-friendly and easy to read. Here are the key elements you should include:

- Contact information: Start your resume with your full name, phone number, professional email address, and location (city and state). If relevant, include a LinkedIn profile or personal website showcasing your credentials and achievements.

- Professional summary: A compelling summary should briefly highlight your experience, key skills, and career goals. To grab the recruiter’s attention, focus on your expertise in financial reporting, budgeting, tax preparation, and compliance.

- Skills section: List technical and soft skills relevant to accounting, such as financial analysis, GAAP compliance, tax regulations, and proficiency in accounting software like QuickBooks or SAP. Including problem-solving and communication skills can further strengthen your profile.

- Work experience: Detail your relevant work experience chronologically with job titles, employer names/ company names, locations, and employment dates. Use bullet points to highlight key achievements, such as cost reductions, improved financial accuracy, or successful audits.

- Education and certifications: Mention your degree (e.g., Bachelor’s in Accounting, Finance, or related field) along with any certifications like CPA (Certified Public Accountant) or CMA (Certified Management Accountant). Certifications can significantly boost your credibility.

- Additional sections (languages, volunteer work, awards): If you have multilingual skills, relevant volunteer experience, or industry awards, include these details to further differentiate yourself from other candidates.

Write a strong professional summary

A professional summary gives you a chance to make a strong first impression. It quickly highlights your experience, key skills, and career goals in two to three sentences, showing employers why you’re the right fit for the job.

Good examples of a resume summary

- “Detail-oriented accountant with 5+ years of experience in financial reporting, tax preparation, and budget analysis. Skilled in using QuickBooks and Excel to streamline financial processes, reducing reporting errors by 20%. Seeking to leverage expertise in compliance and financial management to contribute to XYZ Corporation’s success.”

- “Detail-oriented accountant with 6+ years of accounting experience in preparing financial statements, managing tax returns, and ensuring compliance with accounting principles. Skilled in analyzing financial records and delivering actionable insights that drive tax savings and operational efficiency. Seeking a senior accounting position where I can apply my leadership and technical expertise to support strategic business goals.”

Bad examples of a resume summary

- “I am an accountant looking for a good job. I have some experience with financial reporting and taxes. I am a hard worker and a team player who wants to grow in my career.”

- “I am looking for a job in accounting. I’m good with numbers and like working with spreadsheets. I don’t have much accounting experience, but I’ve always wanted to try it. I worked at a store once and handled the cash register. I hope to work in public accounting even though I don’t have practical experience.”

Writing a compelling summary can be challenging, but Jobscan’s Resume Summary Generator makes it easy. It helps you write a keyword-optimized summary tailored to your target job, ensuring it’s both ATS-friendly and engaging for recruiters.

Demonstrate key accountant skills

To stand out as an accountant, your resume must showcase a strong mix of hard skills (technical expertise) and soft skills (personal attributes). Employers want to see that you have the knowledge to manage financial operations and the communication skills to work effectively with teams and clients.

Hard skills for HR

- Financial Reporting & Analysis

- GAAP & IFRS Compliance

- Tax Preparation & Planning

- Auditing & Risk Management

- Budgeting & Forecasting

- Accounts Payable & Receivable

- Payroll Processing

- Cost Accounting

- Financial Software (QuickBooks, SAP, Oracle, Excel)

- Data Analysis & Reconciliation

Soft skills for HR

- Attention to Detail

- Analytical Thinking

- Problem-Solving

- Time Management

- Communication & Collaboration

- Ethical Judgment & Professionalism

- Adaptability to Changing Regulations

- Leadership & Teamwork

Incorporating key accounting skills into your resume bullet points is essential for highlighting your expertise and value. Below are examples of strong and weak accounting resume bullet points to help guide you.

Write impactful resume bullet points for an accountant

Resume bullet points are the core of your experience section. They should clearly communicate your skills, the impact you’ve made, and the value you bring to a team. Instead of listing tasks, focus on what you accomplished using specific tools, action verbs, and measurable results. Here’s what that looks like:

Good examples of resume bullet points

- “Reduced tax liabilities by 15% through strategic tax planning and compliance management.”

- “Implemented a new budgeting system that increased financial forecasting accuracy by 20%.”

- “Managed accounts payable and receivable, processing over $2M in monthly transactions with 99.9% accuracy.”

Bad examples of resume bullet points

- “Did accounting work for the company.”

- “Helped with taxes and budgeting.”

- “Used Excel for financial reports.”

Let’s be honest—writing powerful, keyword-rich resume bullet points can be frustrating. That’s where Jobscan’s Bullet Point Generator comes in. Designed to take the guesswork out of resume writing, this powerful tool instantly generates high-quality, ATS-friendly bullet points tailored to your industry and experience.

Highlight your achievements as an accountant

As an accountant, your resume shouldn’t just list responsibilities—it should showcase the impact you’ve made. Employers want to see how your expertise has driven financial success, improved efficiency, or ensured compliance. Highlighting your achievements with measurable results sets you apart from other candidates and proves your value to potential employers. Instead of simply stating what you did, show how well you did it with clear, quantifiable accomplishments.

Here are some examples:

- “Reduced company-wide tax issues by 25% through proactive planning and accurate filings, aligning with the responsibilities of a senior tax accountant.”

- “Led the transition to a new financial system at XYZ Company, streamlining financial accounting processes and improving month-end reporting efficiency by 30%.”

- “Trained and mentored junior staff, showcasing strong leadership skills and improving team accuracy in managing accounting services.”

- “Applied specialized cost accountant knowledge to reduce manufacturing overhead by 15%, directly contributing to increased profitability.”

Tailor your resume to the job description

A generic resume won’t get you noticed—but a tailored one will. Hiring managers and applicant tracking systems (ATS) look for resumes that match the job description closely.

Here’s how to do it effectively:

- Analyze the job description: Carefully read the job posting and highlight key skills, responsibilities, and qualifications the employer is looking for.

- Use keywords from the posting: Incorporate important terms like GAAP compliance, tax preparation, financial analysis, budgeting, and auditing in your resume to match ATS filters.

- Customize your professional summary: Align your summary with the job role by emphasizing your most relevant experience and achievements. Example: “CPA-certified accountant with expertise in tax compliance and budget forecasting, seeking to optimize financial operations at XYZ Corp.”

- Adjust your skills section: Prioritize the hard and soft skills mentioned in the job posting. If the role focuses on financial reporting and SAP software, ensure those skills are listed prominently.

- Modify your work experience: Highlight accomplishments that directly relate to the job. For example, if the job emphasizes cost reduction, mention how you identified inefficiencies that saved the company $50K annually.

- Tailor certifications & education: If the job requires a CPA, CMA, or other certification, ensure it’s listed at the top of your resume.

- Match the job title (where possible): If your past job title differs but your role was similar, adjust it slightly to reflect the job posting. For example, if the posting seeks a “Senior Accountant”, and you were a “Lead Financial Analyst”, you can list your title as “Lead Financial Analyst (Senior Accountant Equivalent).”

7. Include relevant education & certifications

Your education and certifications play a crucial role in demonstrating your qualifications as an accountant. Employers want to see that you have the necessary academic background and professional credentials to handle financial responsibilities accurately and efficiently. A well-structured education and certification section enhances your credibility and helps you stand out from other candidates, especially if the job requires specific qualifications.

Here’s how to include relevant education and certifications in your accountant resume:

- List your highest degree first, including the degree name (e.g., Bachelor of Science in Accounting), university, location, and graduation year.

- Highlight relevant coursework if you’re a recent graduate or making a career change (e.g., Courses: Financial Accounting, Taxation, Auditing).

- Include certifications like CPA, CMA, or EA prominently, especially if targeting a senior tax accountant or public accounting role.

- Use the best format—typically reverse chronological order—to showcase your educational background clearly and professionally.

- Only include your GPA if it’s 3.5 or higher and you’re early in your work history.

Top accountant certifications

Earning a professional accounting certification can boost your credibility, increase job opportunities, and lead to higher salaries. Whether you specialize in auditing, tax accounting, or financial management, obtaining the right certification can set you apart in the competitive job market.

- Certified Public Accountant (CPA)

- Chartered Accountant (CA)

- Certified Management Accountant (CMA)

- Chartered Financial Analyst (CFA)

- Certified Internal Auditor (CIA)

- Enrolled Agent (EA)

- Certified Information Systems Auditor (CISA)

- Chartered Global Management Accountant (CGMA)

- Certified Fraud Examiner (CFE)

- Financial Risk Manager (FRM)

Accountant resume tips

Here are key tips to ensure your resume stands out:

- Tailor your resume to the job description: Don’t submit a generic resume. Analyze the job posting and incorporate relevant keywords, skills, and qualifications to match what the employer is looking for. This increases your chances of passing ATS filters and catching a recruiter’s attention.

- Start with a strong professional summary: Begin your resume with a concise, compelling summary that highlights your accounting expertise, years of experience, and key accomplishments. Avoid vague statements—focus on measurable impacts like cost savings, process improvements, or compliance successes.

- Quantify your achievements: Numbers speak louder than words. Instead of saying, “Handled budgeting and financial analysis,” say, “Managed a $5M budget and reduced operational expenses by 12% through strategic cost control.” This makes your impact clear and measurable.

- Use a clean and professional layout: Recruiters spend only a few seconds scanning each resume, so use a clear structure, professional font (Arial, Calibri, or Times New Roman), and logical sections. Avoid excessive graphics or fancy designs that can confuse the ATS software.

- Highlight key accounting skills: List hard skills (e.g., GAAP compliance, tax preparation, financial reporting) and soft skills (e.g., analytical thinking, attention to detail, problem-solving). Make sure they align with the job requirements.

- Optimize for ATS: Most companies use ATS software to organize resumes. Ensure your resume includes job-relevant keywords, standard section headings (like “Work Experience” and “Education”), and is formatted in a simple, ATS-friendly structure (avoid excessive tables, images, or non-standard fonts).

- Showcase certifications & education: List essential certifications like CPA, CMA, CFA, CIA, or EA prominently, especially if the job description requires them. If you’re pursuing a certification, include the expected completion date to show your commitment to professional growth.

- Keep your work experience relevant: Focus on roles and achievements that align with the accounting job you’re applying for. If you have older or unrelated work experience, trim unnecessary details to keep the resume concise and impactful.

- Use action verbs for stronger impact: To make your experience more dynamic and engaging, start each bullet point with a strong action verb like managed, analyzed, reconciled, optimized, or audited.

- Keep it concise (1-2 pages max): Hiring managers don’t have time for lengthy resumes. Keep your resume focused on relevant experience and skills, ensuring it fits within one page (or two if you have extensive experience).

Include a cover letter with your accountant resume

A well-written cover letter can set you apart from other candidates by showcasing your personality, enthusiasm, and why you’re the perfect fit for the role. While your resume lists your skills and experience, your cover letter gives you a chance to tell your story, highlight key achievements, and explain why you’re excited about the opportunity.

Here are some points to consider when writing your cover letter:

- Personalize your greeting by addressing the hiring manager by name. Avoid generic greetings like “To Whom It May Concern.”

- Start with a strong opening that mentions the role you’re applying for and a brief highlight of your qualifications.

- Tailor the content to the company and role—reference specific skills, such as financial reporting, tax preparation, or cost analysis, that match the job description.

- Close with confidence, expressing enthusiasm for the role and a call to action (e.g., “I’d welcome the opportunity to discuss how I can contribute to your team.”).

However, writing a compelling cover letter can be time-consuming and challenging, especially when tailoring it to different job applications. Use Jobscan’s cover letter generator to write a professional, customized cover letter in minutes. Try it today and boost your chances of landing your next accounting job!

Final thoughts

Your resume is more than just a document—it’s your personal brand and your ticket to landing interviews in 2025. You can stand out in a competitive job market with the right mix of tailored keywords, quantified achievements, and ATS-friendly formatting. Whether you’re an experienced CPA or an entry-level accountant, a polished, strategic resume can make all the difference.

Don’t leave your job search to chance—use Jobscan to write your resume and ensure it gets noticed by recruiters and hiring managers. Start today and take control of your career future!

Accountant common interview questions

Below are some common accountant interview questions with strong sample answers to help you impress your interviewer.

How do you ensure accuracy in financial reports?

Answer:

“Accuracy is crucial in accounting. I follow a strict review process, including double-checking calculations, reconciling accounts, and using automation tools like Excel macros to minimize errors. Additionally, I conduct periodic audits to catch discrepancies early and ensure compliance with financial regulations.”

What accounting software are you proficient in?

Answer:

“I have extensive experience with QuickBooks, SAP, and Oracle for financial management and reporting. I also use Excel for data analysis and reconciliation, leveraging advanced formulas and pivot tables to improve efficiency. In my last role, I implemented an automation process in SAP that reduced data entry errors by 30%.”

How do you handle tight deadlines, especially during financial reporting periods?

Answer:

“I prioritize tasks by setting clear deadlines and using project management tools like Trello or Asana to track progress. During peak periods, I stay organized by breaking large tasks into smaller milestones and collaborating with my team to ensure all reports are completed on time. At my previous company, this approach helped us close monthly financials 20% faster.”

Can you explain the difference between accounts payable and accounts receivable?

Answer:

“Accounts payable represent the company’s short-term liabilities—amounts owed to suppliers for goods and services. On the other hand, accounts receivable refers to the money owed to the company by clients or customers for products and services delivered. Managing both effectively is key to maintaining healthy cash flow.”

How do you stay updated with changes in accounting regulations?

Answer:

“I stay updated by regularly reading publications like the Journal of Accountancy and following regulatory bodies like the AICPA and FASB. Additionally, I attend professional development courses and webinars to ensure my knowledge aligns with the latest industry standards.”

Accountant resume frequently asked questions

What are the most important accountant skills to highlight on a resume?

The most essential skills to include on your accountant resume are technical accounting skills like GAAP compliance, financial reporting, tax preparation, and auditing. Additionally, highlight software proficiency (e.g., QuickBooks, SAP, Excel) and soft skills like attention to detail, problem-solving, and analytical thinking. Tailor your skills to match the job description to increase your chances of recruiters finding your resume in the ATS.

How do I include my education experience in an accountant resume?

List your degree, university name, and graduation year in the education section. If you have certifications like CPA, CMA, or CFA, include them in a separate Certifications section. For recent graduates, adding relevant coursework, academic projects, or honors can help demonstrate expertise.

How should I write a resume if I have no experience as an accountant?

Highlight transferable skills from internships, coursework, or related fields like finance. Use a skills-based resume, emphasizing accounting knowledge, software proficiency, and problem-solving. Include certifications, academic projects, or volunteer work to showcase expertise.