Best Finance Resume Examples & Tips for 2025

Stand out in the finance job market with expert-backed finance resume examples, pro tips, and tools to help you land more interviews and impress recruiters.

August 2, 2025

Finance professionals are crucial in driving business decisions, managing risk, and ensuring financial stability across industries. To help you land your ideal finance job, this blog offers professionally curated resume examples and practical tips to make your resume stand out.

According to the U.S. Bureau of Labor Statistics, business and financial occupations are projected to have around 911,400 job openings annually from 2022 to 2032, faster than the average for all occupations. Employers look for candidates with strong analytical abilities, attention to detail, and a proven track record in managing numbers, all of which should be reflected in your resume.

So, whether you’re just starting or eyeing your next big career leap, keep reading. We’re here to guide you in creating a finance resume that truly sets you apart.

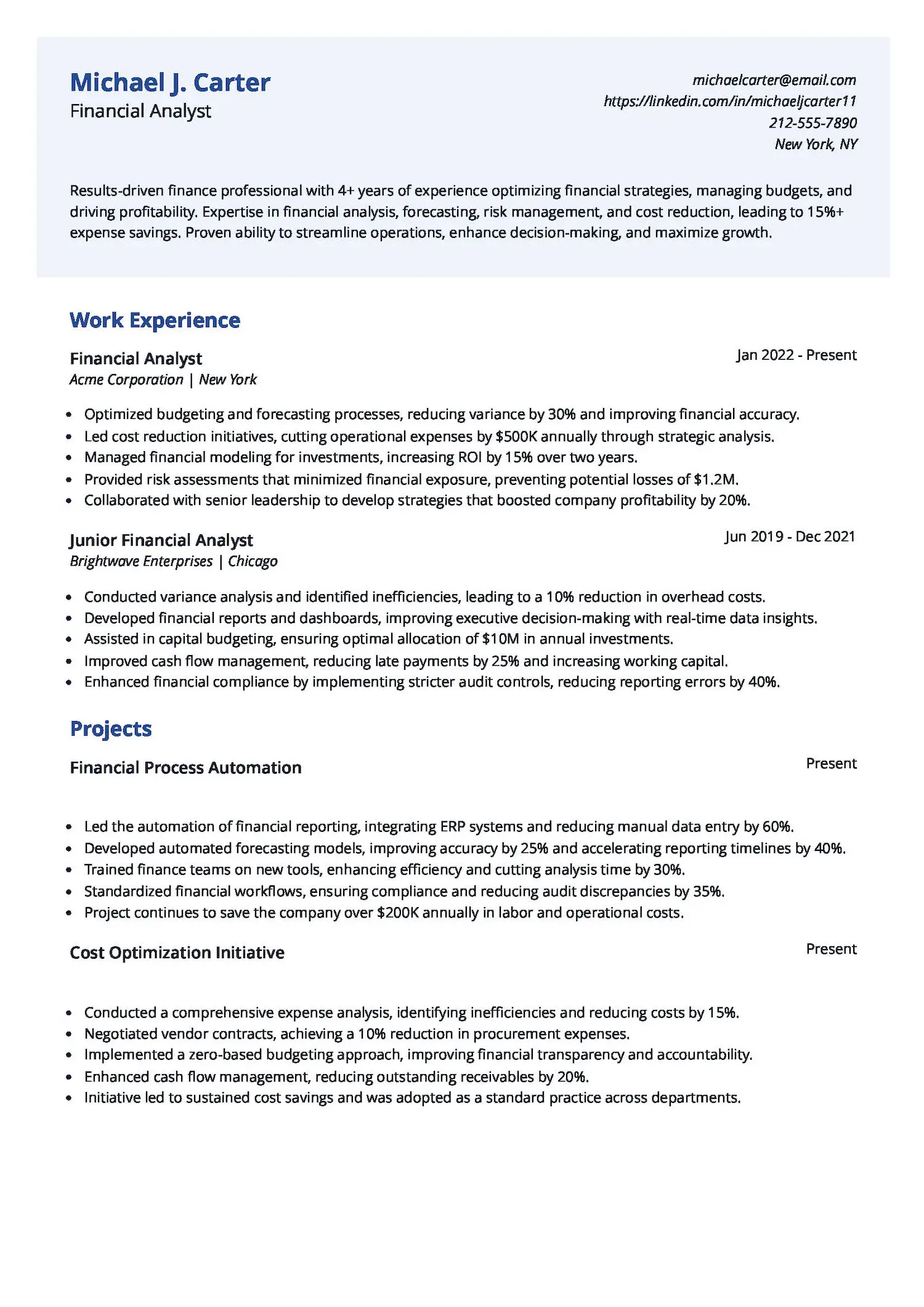

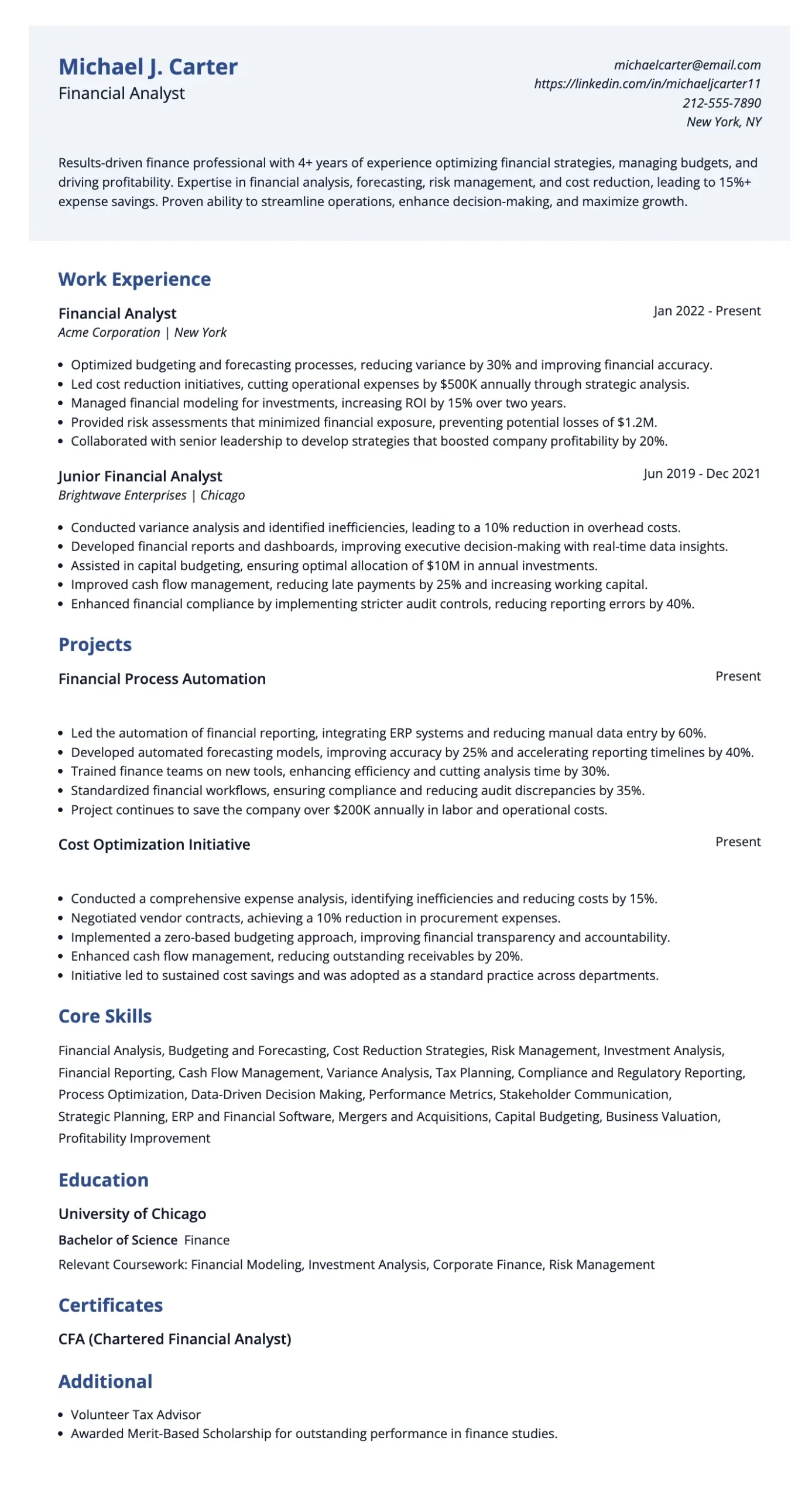

Finance resume example

Struggling to make your finance resume stand out? How do you show your impact beyond daily tasks? This finance resume example is a great place to start. It’s clean, clear, and highlights the right mix of skills and results that hiring managers want to see.

The role calls for someone who can handle data, spot trends, and turn numbers into smart business decisions. Employers look for candidates who know financial tools and reporting and can think strategically, solve problems, and communicate clearly across teams.

This resume template stands out because it’s clear, focused, and easy to scan. The core skills section stands out with a strong mix of hard and soft skills. It includes technical finance skills like budgeting, variance analysis, and capital budgeting, paired with soft skills like strategic planning and stakeholder communication. This balance shows both technical ability and business insight. The clean layout and organized sections make it easy for employers to find what they need fast.

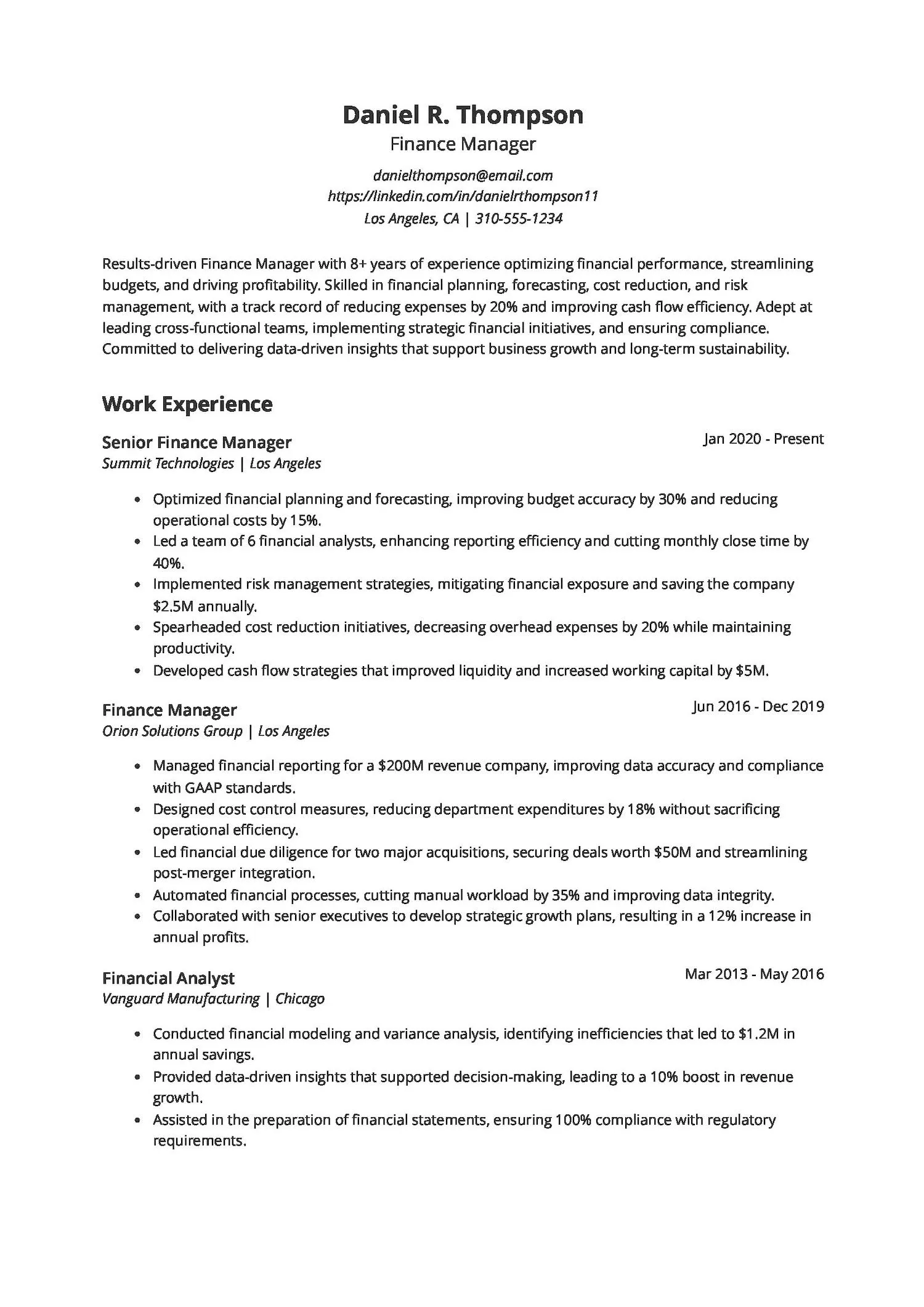

Finance manager resume example

Looking to land a finance role that truly values your ability to drive results? Not sure how to highlight your achievements without sounding too generic? This finance manager resume example shows you exactly how to present your skills, experience, and accomplishments in a clear, results-focused way that grabs attention fast.

A finance manager role calls for someone sharp with numbers, confident in decision-making, and able to guide financial strategy while keeping risks in check. Hiring managers expect candidates who can optimize budgets, lead teams, and improve bottom-line performance—and this resume shows you how to tick all the right boxes.

It highlights strong work experience with clear achievements and real numbers—like cost savings and revenue growth—that show measurable impact. The section also reflects steady career growth from analyst to senior manager. The clean, structured format makes it easy to scan, with key skills and roles laid out clearly. Employers appreciate resumes that get to the point and show precisely how someone can add value, and this one does just that.

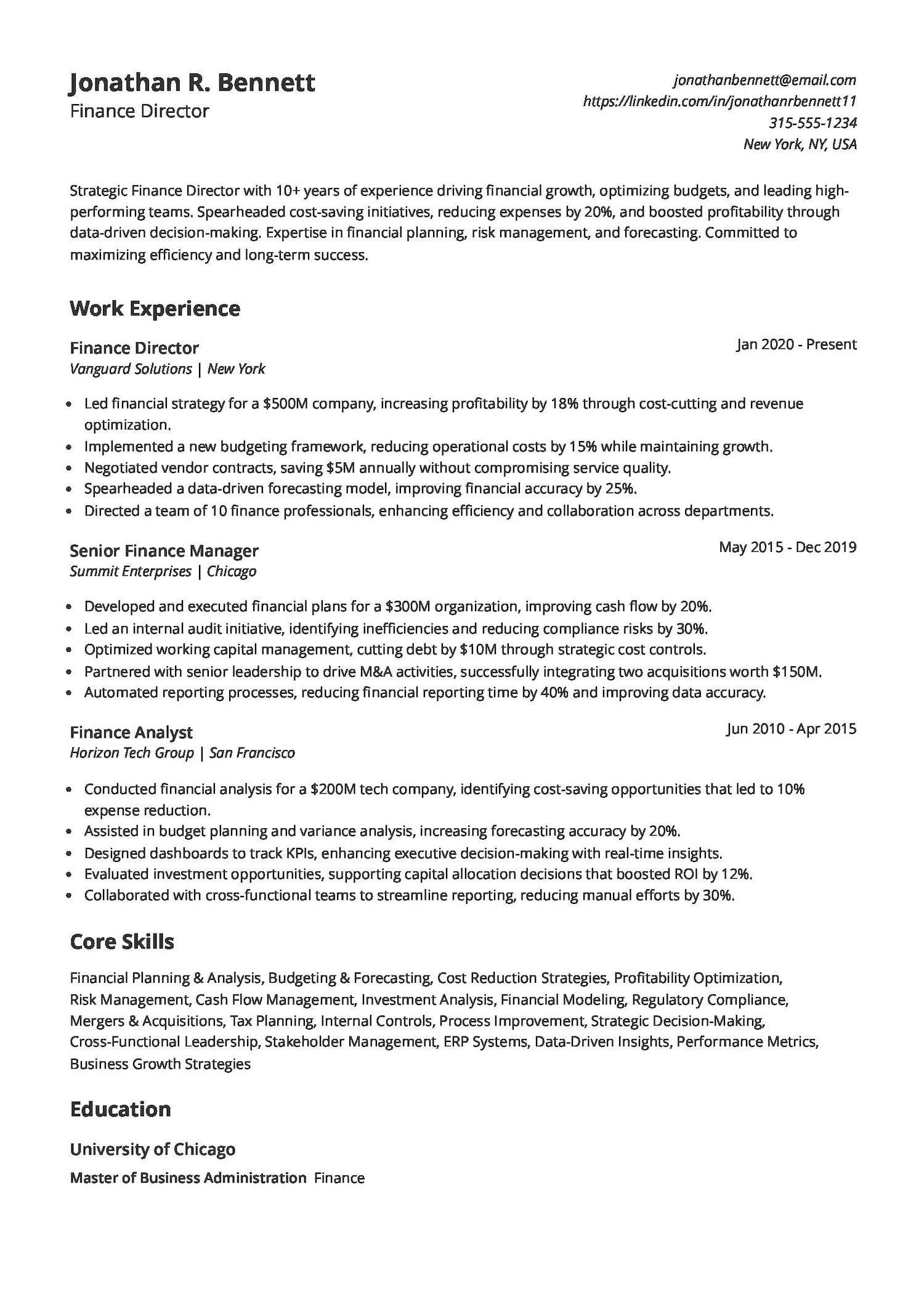

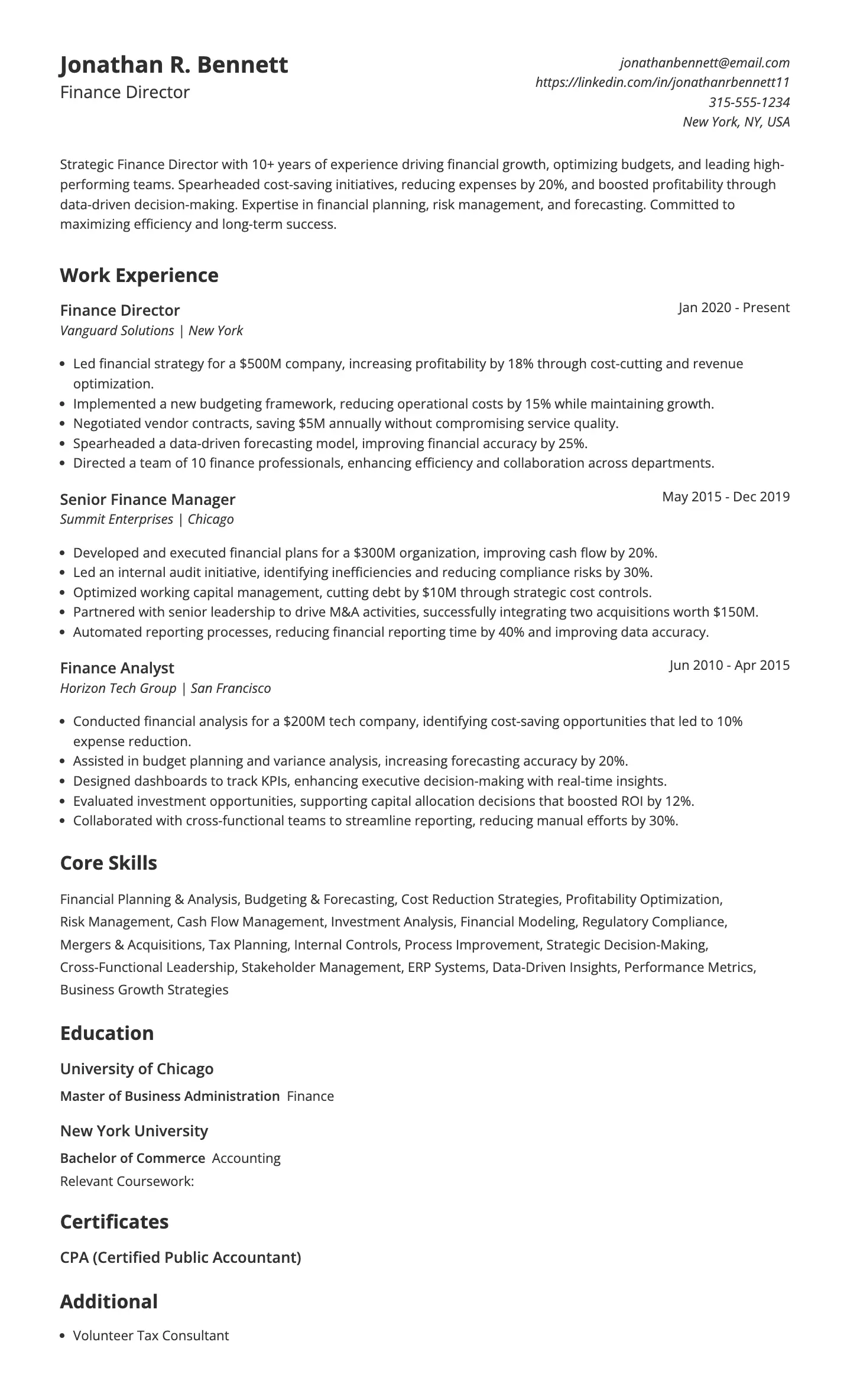

Finance director resume example

Looking to step into a senior finance role but not sure how to show your impact? Struggling to showcase both your strategic mindset and financial results on your resume? This Finance Director resume example is a great starting point. It shows how to turn results into real value, and present them in a way hiring managers notice.

A finance director role calls for more than just crunching numbers. You need to lead teams, drive growth, and handle big-picture decisions. Candidates for this role are expected to show strong leadership, strategic planning, and proven success in managing large budgets and complex projects.

This resume works because it’s packed with results and shows clear career progression. Two standout aspects are the strong use of metrics in every role and the leadership impact shown through team and process improvements. The dedicated Projects section adds real value—it highlights high-level initiatives like M&A integration and ERP rollout that align with executive responsibilities.

It appeals to employers hiring for a director-level role because it shows strategic thinking, big-picture impact, and the ability to lead complex initiatives while delivering measurable results.

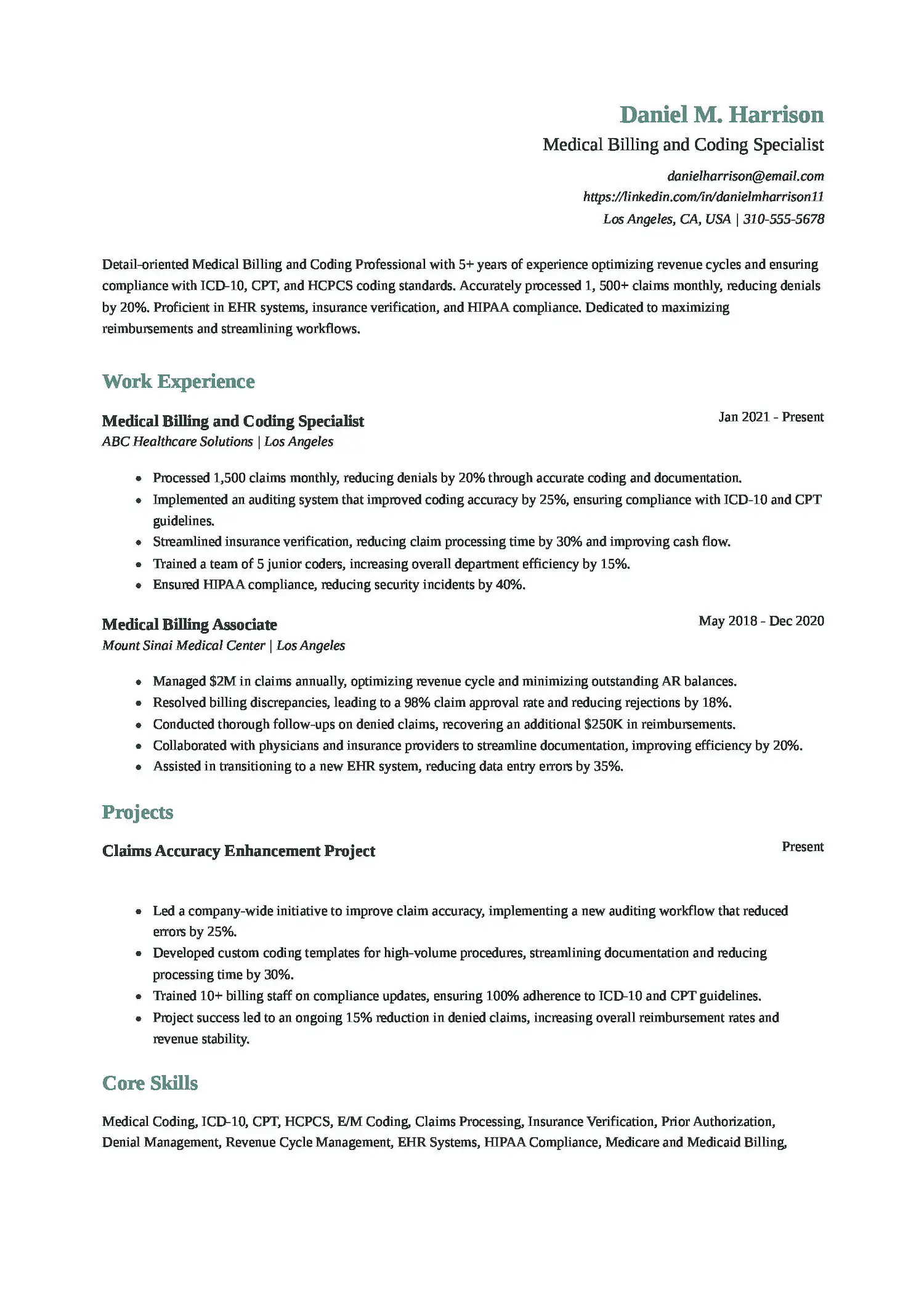

Medical billing and coding resume example

Writing a strong medical billing and coding resume can be tough, especially when you want to show more than just daily responsibilities. If you’re looking for a clear and compelling example, this resume highlights real results, key skills, and exactly what employers want to see.

This role calls for someone who knows the ins and outs of coding systems like ICD-10 and CPT, understands insurance processes, and can reduce errors that delay payments. Employers are looking for accuracy, compliance, and the ability to confidently handle high-volume claims.

It highlights key wins with strong action verbs like “processed,” “implemented,” and “resolved,” making each bullet clear and results-focused. Using metrics shows real impact, while including a dedicated education section with relevant coursework in medical coding adds credibility and value to the resume.

Additionally, it’s easy to scan and well-organized, and it gives employers a quick snapshot of the skills and experience they care about most.

Also Read: 10 Best Resume Skills to Put on a Resume

How to write a finance resume that will get you an interview

Writing a finance resume that grabs attention means more than just listing your past roles. It’s about presenting your qualifications in a way that speaks directly to hiring managers and recruiters—highlighting your value, showcasing your accomplishments, and aligning with what employers are actively looking for.

Many financial institutions and corporations use Applicant Tracking Systems (ATS) to simplify hiring. ATS functions like a search engine—if your resume doesn’t include the right keywords, it might not make it through the initial scan.

For finance roles, hiring managers often search for terms like “financial analysis,” “budget forecasting,” “regulatory compliance,” “risk assessment,” and “financial reporting.” Including these relevant keywords can significantly improve your chances of being noticed.

How ATS works:

- Job posting setup: Employers define job titles, required skills, and qualifications.

- Resume scanning: The system scans incoming resumes for specific terms and structured information.

- Searchable database: Recruiters filter candidates using keywords that match the job requirements.

Even if you’re highly qualified, a resume that isn’t optimized for ATS might get passed over. Clear formatting and the right keywords increase your chances of an interview.

Need help building an ATS-friendly finance resume? Jobscan’s Free Resume Builder helps you structure your resume, add key industry terms, and present your experience effectively—so you stand out to both systems and hiring managers.

Optimize your resume

Use Jobscan's resume scanner to ensure your finance resume is ATS-friendly and includes all the necessary keywords from the job description.

Scan your resume

Key elements of a finance resume

A well-structured finance resume is crucial for making a strong first impression and boosting your chances of landing an interview. One of the first steps is to include the essential elements every finance resume should have, especially those that communicate your career goals and professional value. To make a strong impression, your resume should include:

- Contact details – A clear section with your phone number, email, LinkedIn profile, and optional portfolio or professional website.

- Professional summary – A concise snapshot of your experience, skills, and career highlights.

- Core skills – Key financial abilities such as budgeting, forecasting, financial analysis, risk management, and data interpretation.

- Work experience – Achievements-focused descriptions that showcase your impact in previous roles, using numbers and results wherever possible in the work experience section.

- Projects – Notable finance projects or case studies that demonstrate hands-on expertise and problem-solving capabilities.

- Certifications & education – Relevant degrees or credentials like CFA, CPA, or an MBA that boost your credibility.

Write a strong professional summary

The professional summary is often the first thing a recruiter reads—so make it count. Keep it brief (2–3 sentences), clearly state your role, experience level, and core strengths, and mention any standout achievements or credentials relevant to finance.

Here are some examples of both good and bad professional summaries:

Good examples of a resume summary

- “Detail-oriented financial analyst with 5+ years of experience in budgeting, forecasting, and financial modeling. Proven track record of improving reporting accuracy and driving cost-saving initiatives. Proficient in Excel, SAP, and SQL.”

- “Results-driven finance manager with a decade of experience overseeing multi-million-dollar budgets and cross-functional teams. Adept at risk assessment and strategic planning, with a CPA certification and advanced Excel skills.”

Bad examples of a resume summary

- “Looking for a finance job where I can use my skills and grow professionally.”

- “Hardworking and passionate individual with good communication skills and a love for numbers.”

Take the guesswork out of writing your finance resume summary with Jobscan’s Summary Generator. Simply enter your information, and it will generate a polished, ATS-friendly statement—customized to your finance background and packed with the right keywords to grab recruiters’ attention.

Demonstrate key finance skills

To stand out in the competitive finance job market, your resume should show more than just job titles—it should highlight the skills that prove you’re capable, precise, and strategic. Break your skills into hard and soft categories, and use bullet points in your work experience to demonstrate them in action.

Hard skills for a finance professional

- Financial Modeling

- Forecasting

- Budgeting

- Data Analysis

- GAAP Compliance

- ERP Systems

- Investment Analysis

- Risk Management

- Variance Analysis

- Excel (Advanced)

Soft skills for a finance professional

- Attention to Detail

- Analytical Thinking

- Problem-Solving

- Communication

- Time Management

- Strategic Thinking

- Collaboration

- Leadership

- Adaptability

- Decision-Making

Incorporating these skills into your bullet points allows you to showcase your achievements and expertise. However, there’s an effective and not-so-effective way to present your finance skills in your resume. Let’s look at some examples below to understand this better.

Write impactful resume bullet points for finance

Resume bullet points are the core of your experience section. They should clearly communicate your skills, the impact you’ve made, and the value you bring to a team. Instead of listing tasks, focus on what you accomplished using specific tools, action verbs, and measurable results. Here’s what that looks like:

Good examples of resume bullet points

- “Reduced monthly reporting errors by 30% through streamlined reconciliation processes.”

- “Developed a financial model that identified $500K in annual savings opportunities.”

- “Led budgeting process for a $10M department, improving cost forecasting accuracy by 20%.”

- “Collaborated with cross-functional teams to implement a new ERP system ahead of schedule.”

Bad examples of resume bullet points

- “Responsible for financial reporting.”

- “Worked on the budget.”

- “Helped with forecasting.”

- “Did monthly reconciliations.”

Try Jobscan’s Bullet Point Generator to create powerful, results-driven resume bullet points. Just upload your resume and the job description to your Jobscan dashboard, and the tool will generate tailored phrase suggestions that highlight your skills and achievements with precision.

Highlight your achievements as a finance professional

Recruiters want more than a list of tasks—they’re looking for proof of your impact. Highlighting your accomplishments with measurable results sets your resume apart. Rather than listing routine responsibilities, focus on how you’ve added value, improved processes, or contributed to financial performance.

Here are a few examples of how you can highlight your achievements effectively:

- “Identified $250K in cost-saving opportunities through detailed variance analysis and budget reviews.”

- “Streamlined month-end closing process, reducing reporting time by 40% while improving accuracy.”

- “Led financial planning for a $15M portfolio, resulting in a 12% increase in ROI over 12 months.”

Tailor your resume to the job description

Submitting the same resume for every finance job might seem efficient, but it can cost you valuable interview opportunities. A tailored resume is most readable by the ATS and shows hiring managers you’re a strong match for the role.

Here’s how to tailor your resume to the job description:

- Analyze the job description: Look for key financial skills, certifications, and responsibilities listed in the job description, like forecasting, budgeting, or proficiency in specific tools.

- Use the right keywords strategically: Naturally include relevant terms in your professional summary, skills, and experience sections.

- Highlight matching experience: Emphasize duties and accomplishments that closely align with the role’s core requirements.

- Customize your professional summary: Showcase how your finance background directly supports the goals of the position.

- Adjust bullet points: Focus on quantifiable results and achievements that reflect what the employer is looking for.

- ATS optimization: Use clean formatting and standard fonts, and avoid graphics or columns to ensure your resume is ATS-friendly.

Also Read: The Top 5 ATS Resume Keywords of 2025

Include relevant education and certifications

Your education and certifications demonstrate to employers that you have the foundational knowledge and specialized training needed for a finance role.

Here’s how to do it effectively:

- List your degree, major, and institution in a clear, concise format (e.g., Bachelor of Science in Finance, XYZ University).

- If you’re a recent graduate, include your graduation year and any relevant coursework such as financial accounting, corporate finance, or investment analysis.

- For experienced professionals, keep it brief, focusing on your highest degree and any advanced education.

- If you’re transitioning into finance from another field, highlight coursework or certifications that align with your new career path.

- Include key finance certifications that reflect your expertise and commitment to the industry (e.g., Chartered Financial Analyst (CFA), Certified Public Accountant (CPA), Financial Risk Manager (FRM)).

- If you specialize in a specific area, such as investment analysis or financial planning, include certifications relevant to that niche.

- For seasoned professionals, focus on high-impact, industry-recognized credentials rather than listing every training program.

Top finance certifications

Here are some of the top finance certifications that can strengthen your resume:

- CFA (Chartered Financial Analyst)

- CPA (Certified Public Accountant)

- CMA (Certified Management Accountant)

- FRM (Financial Risk Manager)

- CFP (Certified Financial Planner)

- CAIA (Chartered Alternative Investment Analyst)

Finance resume tips

A strong finance resume doesn’t just list your experience—it demonstrates your value through clarity, precision, and relevance. Here are some key tips to help your resume stand out:

- Quantify your achievements: Use numbers to show impact—percentages, dollar amounts, or time saved all help recruiters understand your contributions.

- Keep it concise: Stick to a one-page resume if you’re early in your career, and two pages max for experienced professionals.

- Use a clean layout: Choose a professional, easy-to-read format with standard fonts and clear section headings.

- Tailor for each job: Customize your resume with keywords and skills from the job description to get past ATS filters.

- Prioritize relevant experience: Focus on accomplishments that align with the finance role you’re applying for.

- Avoid vague language: Replace phrases like “responsible for” with strong action verbs like “led,” “developed,” or “analyzed.”

- Use strong action verbs: Begin each bullet point with impactful verbs to clearly convey your role and achievements.

- Proofread thoroughly: Finance demands accuracy—typos or formatting issues can make a bad impression fast. Double-check your resume or use tools like Jobscan to ensure it’s polished and optimized.

Also Read: How to Organize Your Resume Sections to Stand Out?

Include a cover letter with your finance resume

A well-written cover letter can help you stand out from other finance candidates by showcasing your interest in the company and emphasizing your most relevant achievements. While your resume outlines your qualifications, the cover letter allows you to explain why you’re the right fit for the role and highlight your career goals.

What to include in your finance cover letter:

- A strong opening: Clearly state the position you’re applying for and express enthusiasm for the company or team.

- Relevant experience: Highlight specific finance skills or accomplishments that match the job description.

- Value-driven focus: Emphasize how your analytical skills or financial insights have contributed to business outcomes.

- A compelling closing: End with a confident statement about your fit for the role and a call to action, such as requesting an interview.

Use Jobscan’s Cover Letter Generator to write a professional, ATS-optimized cover letter that complements your resume and captures the attention of hiring managers.

Wrte the perfect finance resume with Jobscan

A well-optimized finance resume can help you stand out in a competitive job market and capture the attention of hiring managers. Use our finance resume examples to write a strong, ATS-friendly resume that showcases your skills and gets you one step closer to landing your ideal role.

Ready to take the next step in your finance career? Jobscan offers a range of AI-powered tools to boost your job search. Tools like the resume scanner, One-Click Optimize, and LinkedIn Optimization analyze your resume against real job descriptions to ensure it meets ATS and recruiter expectations. By identifying missing keywords and formatting improvements, Jobscan helps you fine-tune each application and increase your chances of getting interviews.

Try our free resume builder and optimize your finance resume today!

Finance common interview questions

Tell me about a time you identified a financial risk and how you handled it.

Answer:

“At my previous company, I noticed a pattern of declining profit margins in our quarterly reports. After investigating, I found a supplier cost increase that hadn’t been factored into pricing. I presented a revised pricing strategy and renegotiated vendor terms, helping the company recover an estimated $80,000 annually.”

How do you ensure accuracy in your financial reports?

Answer:

“I rely on a combination of double-checking formulas, cross-referencing with source data, and maintaining well-organized documentation. I also use tools like Excel auditing functions and reconciliation checks to catch inconsistencies before submission.”

What financial software or tools are you proficient in?

Answer:

“I’m proficient in Microsoft Excel, QuickBooks, and SAP. I also have experience with financial modeling tools and BI platforms like Tableau and Power BI to generate insights and dashboards for stakeholders.”

How do you stay updated with financial regulations and market trends?

Answer:

“I regularly follow financial news via sources like Bloomberg and The Wall Street Journal. I’m also a member of industry groups on LinkedIn and attend webinars or read updates from the CFA Institute to stay informed on regulatory changes and best practices.”

Finance resume frequently asked questions

What are the most crucial finance skills to highlight on a resume?

To secure first place in the competitive job market, candidates must present a well-rounded skill set tailored to the role. Employers are looking for strong leadership skills—a balance of hard and soft skills. On the technical side, expertise in Financial Analysis, Budgeting, Forecasting, Risk Management, Excel, and Financial Reporting is essential, especially when working with financial statements. Equally important are soft skills such as Attention to Detail, Problem-Solving, and Communication, which enhance decision-making and team collaboration.

How do I include my education experience in a finance resume?

List your degree, major, and institution (e.g., Bachelor of Science in Finance, ABC University). If you’re a recent graduate, include your graduation year and relevant coursework such as corporate finance or investment strategies. For experienced professionals, highlight your highest degree and applicable certifications like CFA Level I, II, or III.

How should I write a resume if I have no experience in finance?

Emphasize transferable skills from previous roles, like data analysis, project management, or working with budgets. Include relevant coursework, internships, certifications, or personal finance projects. A strong summary, a tailored skills section, and bullet points that show problem-solving and analytical thinking are the best way to make your resume stand out.