Best Financial Advisor Resume Examples & Tips 2025

Want the perfect financial advisor resume? Explore financial advisor resume examples, proven formats, essential skills, and expert tips to help you land the job in 2025!

August 2, 2025

Financial advisors play a pivotal role in guiding individuals and businesses toward sound financial decisions, encompassing areas like investment strategies, retirement planning, and wealth management. This blog offers expert-written resume examples and actionable tips to help you create a compelling financial advisor resume that stands out to potential employers.

According to the U.S. Bureau of Labor Statistics, employment of personal financial advisors is projected to grow 17%from 2023 to 2033, much faster than the average for all occupations . Employers seek candidates who not only possess strong analytical and financial skills but also excel in building client relationships. A well-structured resume is essential to showcase these qualities effectively and secure a position in this competitive field.

Ready to elevate your financial advisor resume? Let’s dive in and explore how you can write a resume that highlights your strengths and aligns with what employers are looking for.

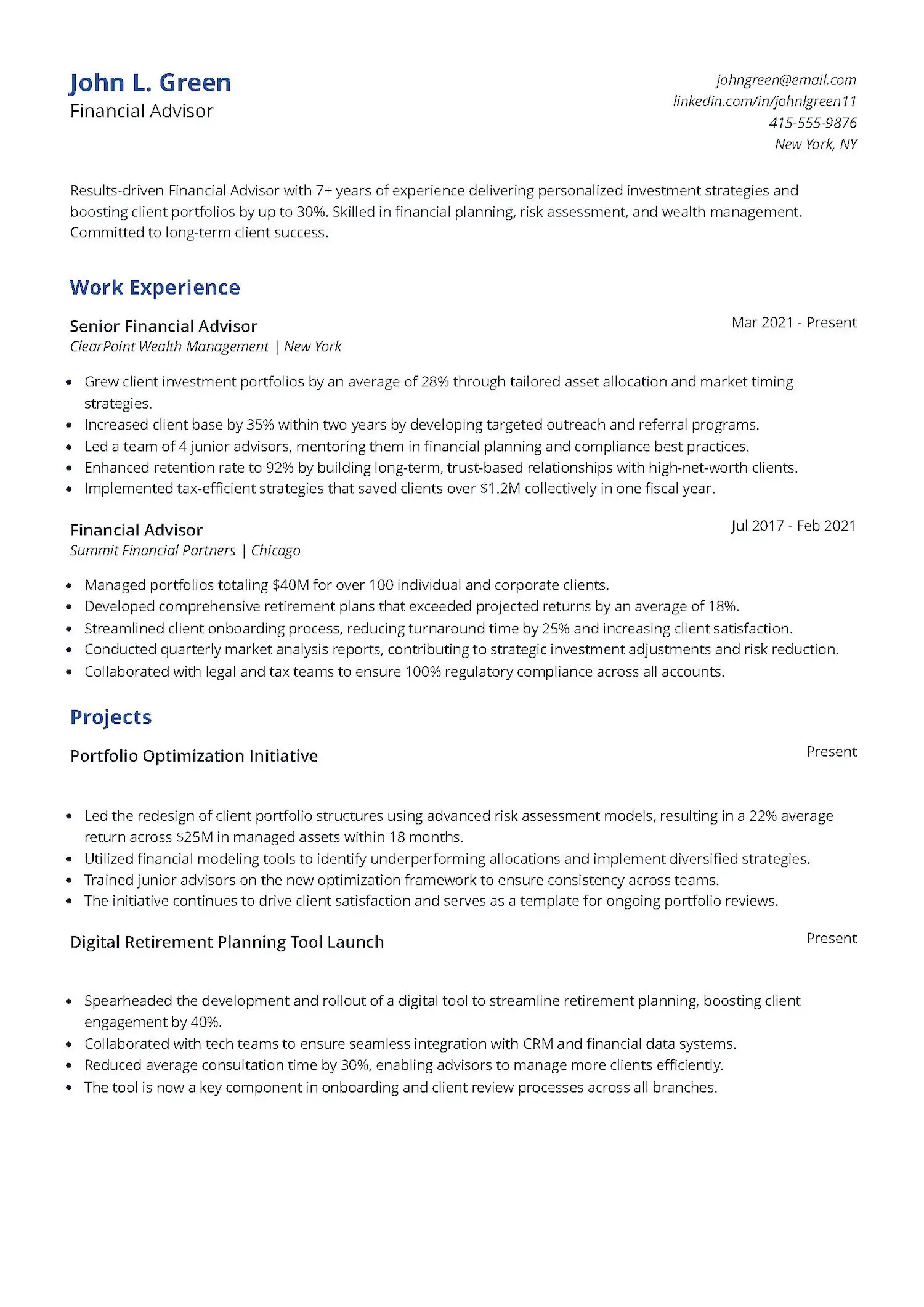

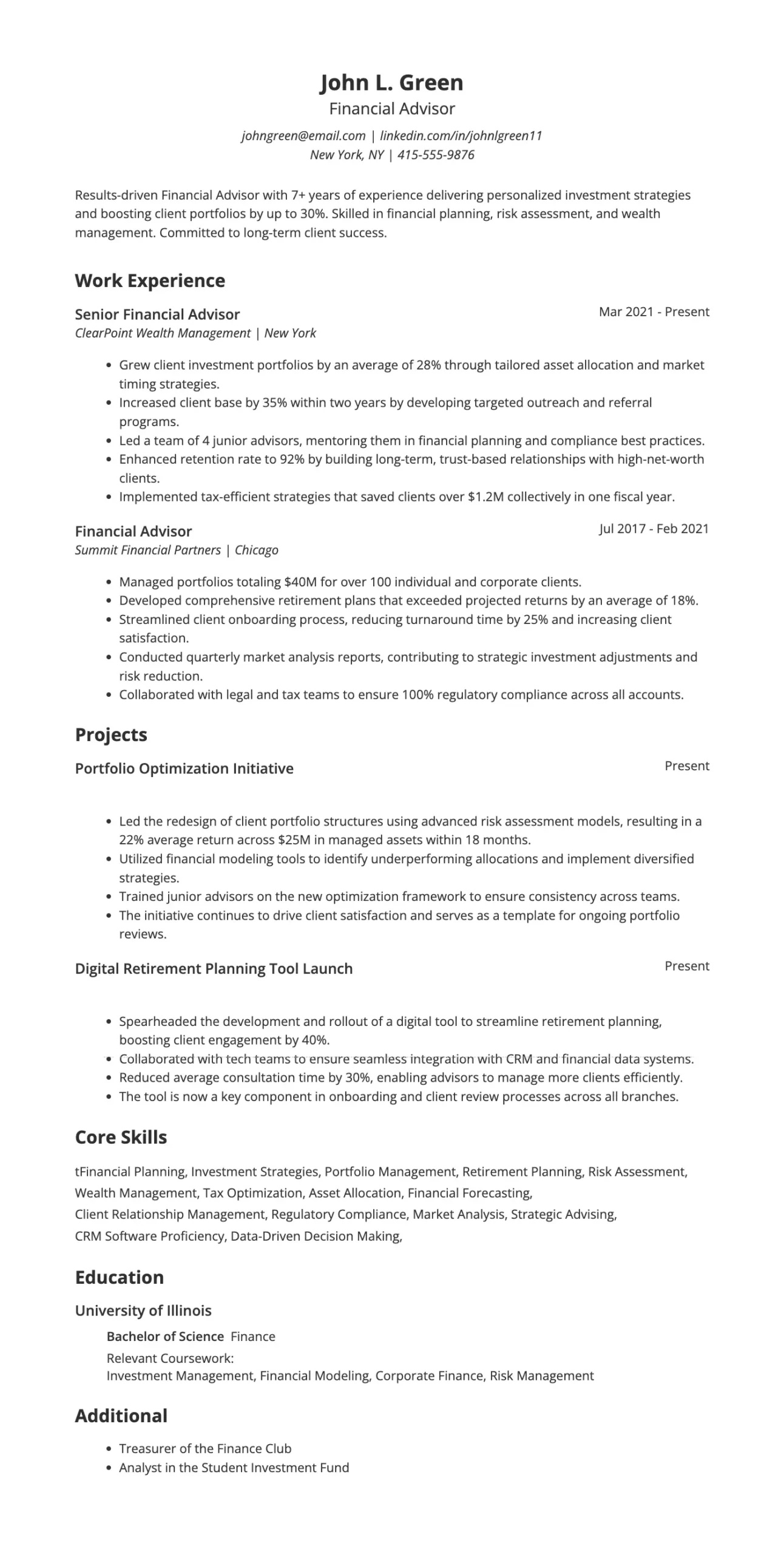

Financial advisor resume example

Looking to break into a career where numbers speak louder than words? Want to showcase your ability to grow wealth, build client trust, and offer smart financial guidance? This financial advisor resume example highlights exactly what makes a strong impression—solid results, leadership, and client-focused strategy.

Financial advisor roles call for more than just crunching numbers. Employers are looking for candidates who can create personalized plans, manage portfolios, stay compliant, and most importantly, build lasting client relationships. Your resume should show you can do just that—clearly, confidently, and with real impact.

This resume template stands out by showing real numbers—like a 28% portfolio growth and $1.2M in tax savings—which instantly shows impact. It also highlights leadership by including mentorship and project ownership. Employers appreciate clear results and proven skills, and this resume makes it easy to see both at a glance. It’s focused, achievement-driven, and tailored to what hiring managers want.

Also Read: 10 Best Resume Skills to Put on a Resume

How to write a financial advisor resume that will get you an interview

A compelling financial advisor resume is your first step toward landing interviews at top firms. Whether you’re just starting out or have years of experience managing portfolios and client relationships, your resume needs to showcase your financial knowledge, client service skills, and ability to drive results.

Many financial firms and large institutions use Applicant Tracking Systems (ATS) to simplify the hiring process. ATS functions like a search engine—if your resume doesn’t include the right keywords, it may not reach a hiring manager.

For financial advisor roles, recruiters often search for terms like “portfolio management,” “financial planning,” “client acquisition,” “retirement strategies,” “risk assessment,” and “CFP® certification.” Including these keywords naturally throughout your resume can improve your visibility and help you make it through the first round of screening.

How ATS works:

- Job posting setup: Employers define the required job title, skills, and qualifications.

- Resume scanning: The system scans incoming resumes for relevant keywords and experience.

- Searchable database: Hiring managers search by keywords to identify the most qualified candidates.

Even if you have a strong background, a poorly optimized resume can be filtered out before anyone reviews it. Using industry-relevant terms and keeping your resume clean and well-formatted can boost your chances of landing an interview.

Need help creating an ATS-friendly resume? Tools like Jobscan’s Free Resume Builder can help you structure your resume and include the right financial planning keywords to stand out in the hiring process.

Optimize your resume for free

Use Jobscan's resume scanner to ensure your financial advisor resume is ATS-friendly and includes all the necessary keywords from the job description.

Scan your resume

Key elements of a financial advisor resume

Your resume should clearly reflect your financial expertise while being easy to scan quickly. Make sure it includes:

- Contact information: Include your full name, phone number, professional email, LinkedIn profile, and optional certifications (e.g., CFP®, CFA®) in your contact details.

- Professional summary: A short paragraph summarizing your experience, strengths, and key achievements.

- Core skills: A bullet list of relevant hard and soft skills such as investment strategy, financial planning, client retention, and risk assessment.

- Work experience: List your most relevant roles, focusing on measurable results (e.g., “Increased client portfolio by 25% YoY”) in your work experience section in reverse chronological order.

- Projects: Highlight independent or company-led initiatives, such as “Developed a new client onboarding process that improved efficiency by 30%.”

- Education: Include your degrees, relevant coursework, and honors if applicable.

- Certifications and licenses: Such as Series 7, Series 66, CFP®, or CPA.

- Career achievements and awards: Any recognition or performance milestones can help build credibility.

- Technical tools: Mention tools and platforms like Salesforce, Morningstar, eMoney, or Microsoft Excel if relevant.

Write a strong professional summary

Your professional summary should act like your elevator pitch—concise, impactful, and tailored to the role you want. Focus on what makes you a valuable asset to employers and what you’ve achieved in previous roles.

Here are a few examples of both good and bad professional summaries:

Good examples of a resume summary

- “Experienced financial advisor with 8+ years of success in portfolio management, retirement planning, and high-net-worth client acquisition. Proven ability to grow client assets by 30% annually through personalized investment strategies and proactive financial reviews.”

- “Detail-oriented CFP® with 6 years of experience helping clients reach long-term financial goals. Skilled in tax planning, estate planning, and asset allocation. Increased client satisfaction scores by 40% through strategic communication and financial service improvements.”

Bad examples of a resume summary

- “I am looking for a financial advisor job where I can grow and help clients. I have worked in finance for a few years.”

- “Hardworking and motivated. I like working with people and helping them manage money. Looking for a new opportunity.”

Let Jobscan’s Summary Generator take the guesswork out of writing your professional summary. Just enter your experience and background, and it will write a polished, ATS-friendly summary tailored to your financial expertise—helping you stand out to recruiters and hiring managers.

Demonstrate key financial advisor skills

Financial advisors need a mix of technical financial knowledge and strong interpersonal abilities. Your resume should highlight both hard and soft skills that show you can analyze numbers and build trust with clients. This section breaks down what to include—and how to present it effectively.

Hard skills for a financial advisor

- Investment Strategy

- Portfolio Management

- Retirement Planning

- Estate Planning

- Risk Assessment

- Tax Planning

- Asset Allocation

- Regulatory Compliance

- Financial Models

- Forecasting

- CRM Software

- Financial Software

- Data Analysis

- Microsoft Excel

- Morningstar

Soft skills for a financial advisor

- Communication

- Active Listening

- Client Relations

- Problem Solving

- Empathy

- Adaptability

- Time Management

- Attention to Detail

- Ethical Judgment

- Strategic Thinking

- Presentation Skills

- Decision Making

Effectively incorporating these skills into your resume bullet points helps highlight both your impact and financial expertise. But simply listing day-to-day tasks isn’t enough. How you present your experience as a financial advisor can make all the difference in catching a recruiter’s attention. Let’s look at some examples of how to showcase relevant skills the right way—and what to avoid.

4. Write impactful resume bullet points for a financial advisor

Good examples of resume bullet points

- “Managed over $40M in client assets and delivered 12% average annual portfolio growth over 3 years.”

- “Developed personalized retirement plans for 75+ clients, resulting in a 98% client satisfaction rate.”

- “Implemented a tax-efficient investment strategy that saved clients an average of $2,500 annually.”

- “Trained and mentored junior advisors, contributing to a 20% increase in departmental productivity.”

- “Used Salesforce to streamline client communication and follow-ups, improving retention by 30%.”

Bad examples of resume bullet points

- “Helped people with money stuff and retirement.”

- “Did meetings with clients and talked about finances.”

- “Worked on investments and used some software.”

- “Handled some portfolios and answered calls.”

- “Was responsible for helping with financial plans.”

Use Jobscan’s Bullet Point Generator to write impactful, results-driven resume bullet points tailored to financial advisor positions. Upload your resume and the job description to your Jobscan dashboard, and the tool will generate customized suggestions that highlight your financial expertise, client successes, and measurable achievements.

Highlight your achievements as a financial advisor

Hiring managers aren’t just looking for a list of responsibilities—they want to see the value you’ve delivered. Whether it’s growing client assets, increasing retention rates, or improving financial planning outcomes, measurable achievements help showcase your impact and effectiveness.

Here are a few examples of how to turn everyday tasks into standout accomplishments:

- “Increased client portfolio value by 30% year-over-year through strategic asset allocation and ongoing performance reviews.”

- “Created personalized retirement plans for over 100 clients, resulting in a 95% satisfaction rate and strong long-term retention.”

- “Led educational financial workshops that generated 25 new high-net-worth client leads within one quarter.”

- “Streamlined the onboarding process using CRM tools, reducing onboarding time by 40% and enhancing client experience.”

Tailor your resume to the job description

Using the same resume for every financial advisor role might save time, but it can hurt your chances of landing interviews. A customized resume improves your chances of getting past the applicant tracking system (ATS) and shows hiring managers you’re a strong fit for the position.

Here’s how to tailor your resume to the job description:

- Analyze the job posting: Identify key qualifications, tools, and focus areas such as “wealth management,” “CFP® c”rtification,” “fina”cial planning software,” or “c”ient”acquisition.”

- Use r”levant keywords: Naturally incorporate these terms into your summary, skills, and work history sections.

- Emphasize matching experience: Highlight past roles or projects where you’ve handled similar responsibilities, such as retirement planning, portfolio diversification, or tax-efficient investment strategies.

- Customize your summary: Briefly explain how your background aligns with the firm’s goals and the role’s expectations.

- Refine your bullet points: Prioritize results that mirror the employer’s needs, such as increasing assets under management or reducing client churn.

- Optimize for ATS: Use a clean, professional format with standard fonts. Avoid graphics, columns, or overly complex layouts so that screening systems can easily read your resume.

Also Read: The Top 5 ATS Resume Keywords of 2025

Include relevant education and certifications

Your education and certifications show you have the financial knowledge, regulatory understanding, and professional training required for a financial advisor role.

Here’s Here’s present them effectively:

- Include your degree, major, and university in a clear format (e.g., Bachelor of Science in Finance, ABC University).

- If you’re a recent graduate, list your graduation year and relevant coursework such as Investments, Financial Planning, Economics, or Taxation.

- For experienced professionals, keep it concise—focus on higher education and professional certifications.

- If you’re transitioning from another field, highlight any relevant finance or advisory training, such as online courses, certification programs, or workshops.

- List certifications that validate your financial planning skills and demonstrate your commitment to the industry (e.g., CFP®, ChFC®, Series 7).

- If you specialize in a certain area, include certifications that reflect that, such as those in retirement planning, wealth management, or tax strategies.

- Senior-level advisors should prioritize well-recognized credentials and avoid listing every short course or entry-level certificate.

Top financial advisor certifications

Here are some valuable certifications that can help strengthen your resume:

- Certified Financial Planner (CFP®)

- Chartered Financial Consultant (ChFC®)

- Chartered Financial Analyst (CFA®)

- Series 7 – General Securities Representative License

- Series 66 – Uniform Combined State Law License

- Certified Investment Management Analyst (CIMA®)

- Accredited Financial Counselor (AFC®)

- Personal Financial Specialist (PFS)

- Retirement Income Certified Professional (RICP®)

Financial advisor resume tips

Creating a standout resume is more than listing your key skills and experience—it’s about presenting your value as a financial advisor in a way that resonates with recruiters and hiring managers. These tips will help you fine-tune your resume for maximum impact:

- Keep it concise: Stick to one page if you have under 10 years of experience. Focus on your most relevant and recent roles.

- Emphasize results, not just responsibilities: Use metrics and outcomes to show the impact of your work—like increased assets under management or improved client retention.

- Use financial keywords strategically: Include industry terms from the job description, such as wealth management, retirement planning, risk assessment, or portfolio analysis.

- Start with strong action verbs: Begin bullet points with words like Advised, Managed, Optimized, Developed, or Implemented to clearly show your contributions.

- Highlight client-facing and analytical strengths: Balance your resume by showing both your financial acumen and relationship-building skills.

- Customize your resume for each job: Tailor your summary, specific skills, and bullet points to match the priorities of the specific role you’re applying for.

- Include credentials and licenses: Add links to your FINRA BrokerCheck profile or include certification designations like CFP® or Series 7.

- Show your advisory process: Briefly reference your approach to client engagement, goal-setting, financial planning, or investment strategy.

- Proofread and format carefully: Errors in spelling or formatting can create a poor impression—ensure your resume is clean, professional, and ATS-friendly.

Also Read: How to Organize Your Resume Sections to Stand Out?

Include a cover letter with your financial advisor resume

A well-written cover letter can help you stand out from other financial advisor candidates by showcasing your commitment to helping clients reach their financial goals. While your resume highlights your qualifications and credentials, a cover letter gives you the opportunity to personalize your application and explain why you’re the right fit for the role.

What to include in your financial advisor cover letter:

- A strong opening: Clearly mention the position you’re applying for and express your enthusiasm for the firm’s mission or client approach.

- Relevant experience: Highlight your financial planning skills, certifications, and success stories that align with the job description.

- Client-focused mindset: Emphasize your ability to build long-term relationships, develop customized financial strategies, and adapt to client needs.

- A compelling closing: Finish with confidence—briefly summarize why you’re a strong match for the role and express your interest in an interview.

Use Jobscan’s Cover Letter Generator to create a personalized, ATS-friendly cover letter that complements your resume and catches the attention of hiring managers.

Create a standout financial advisor resume with Jobscan

A well-structured financial advisor resume can be the key to landing interviews at top firms. By focusing on your financial expertise, tailoring your content to the job description, and demonstrating your real-world impact, you can stand out in a competitive job market. Pair your resume with a tailored cover letter to create a strong, memorable first impression.

Need help creating a polished, professional resume? Try Jobscan’s free Resume Builder to quickly generate a customized, ATS-friendly resume. Just enter your details, and the tool will format it to industry standards—helping you get noticed faster by hiring teams.

Financial advisor common interview questions

How do you approach creating a financial plan for a new client?

Answer:

“I begin by conducting a detailed discovery session to understand the client’s short- and long-term goals, current financial situation, risk tolerance, and investment opportunities. From there, I analyze their income, expenses, assets, and liabilities to develop a tailored financial plan. I ensure the client understands each component and make adjustments based on their feedback to create a strategy they feel confident about.”

How do you build and maintain long-term relationships with clients?

Answer:

“I prioritize regular communication and transparency. I schedule periodic reviews to assess progress toward their financial goals and make necessary adjustments. I also stay updated on market trends and proactively share relevant insights. Building trust and showing that I’m invested in their long-term success has been key to client retention.”

How do you handle clients with a low risk tolerance who want high returns?

Answer:

“I educate clients on the relationship between risk and return and help them set realistic expectations. I focus on building diversified portfolios that align with their comfort level while still seeking opportunities for growth. By clearly explaining strategies and using tools to model potential outcomes, I help them feel informed and in control of their financial choices.”

How do you stay current with financial regulations and market trends?

Answer:

“I subscribe to industry publications, attend webinars, and maintain my certifications through continuing education. I also participate in local professional networking groups where advisors share insights. Staying informed helps me provide clients with up-to-date guidance and ensure compliance with all regulatory requirements.”

Financial advisor resume frequently asked questions

What are the most important financial advisor skills to highlight on a resume?

Hiring managers look for a mix of technical skills and interpersonal skills. Some of the most important ones to highlight include investment strategy, portfolio management, risk assessment, financial planning, retirement planning, client relationship management, communication, and analytical thinking. Be sure to tailor these skills to the specific job description and support them with examples in your work history or accomplishments section.

How do I include my education experience in a financial advisor resume?

List your highest relevant degree in the education section, including the institution name and your graduation year if applicable. For example: Bachelor of Science in Finance, ABC University – City, State. If you’re a recent graduate, you can also mention relevant coursework such as Investment Analysis, Wealth Management, or Economics, along with any honors or leadership roles that reflect your capabilities.

How should I write a resume if I have no experience as a financial advisor?

If you’re new to the field, focus on transferable skills and related experiences. Highlight any relevant coursework, certifications like the Series 7 or CFP®, or internships. Emphasize soft skills such as communication, attention to detail, and client service. Include any past professional experience in sales, banking, customer service, or data analysis that demonstrates your financial literacy and ability to work with clients. You can also add a strong professional summary that expresses your enthusiasm for financial advising and your willingness to grow in the field. If you’ve completed personal finance projects or built mock portfolios, consider including those in a “Projects” section to show initiative.