Accounting Resume Examples for 2025: Expert Tips & Templates

Struggling to create an accounting resume that stands out? This guide covers expert tips, resume examples, and ATS-friendly strategies to help you land more interviews.

July 15, 2021

Accountants are the cornerstone of any business, ensuring financial health and compliance. In this blog, we’ll provide expertly written resume examples and valuable insights to help you stand out in the competitive accounting field.

According to the U.S. Bureau of Labor Statistics, the employment of accountants is projected to grow by 6% from 2023 to 2033. Employers seek accountants who excel in financial analysis, accuracy, and time management. A well-written resume is key to securing the right opportunity.

Ready to take your resume to the next level? Keep reading for tips, examples, and everything you need to create a standout resume that grabs recruiters’ attention!

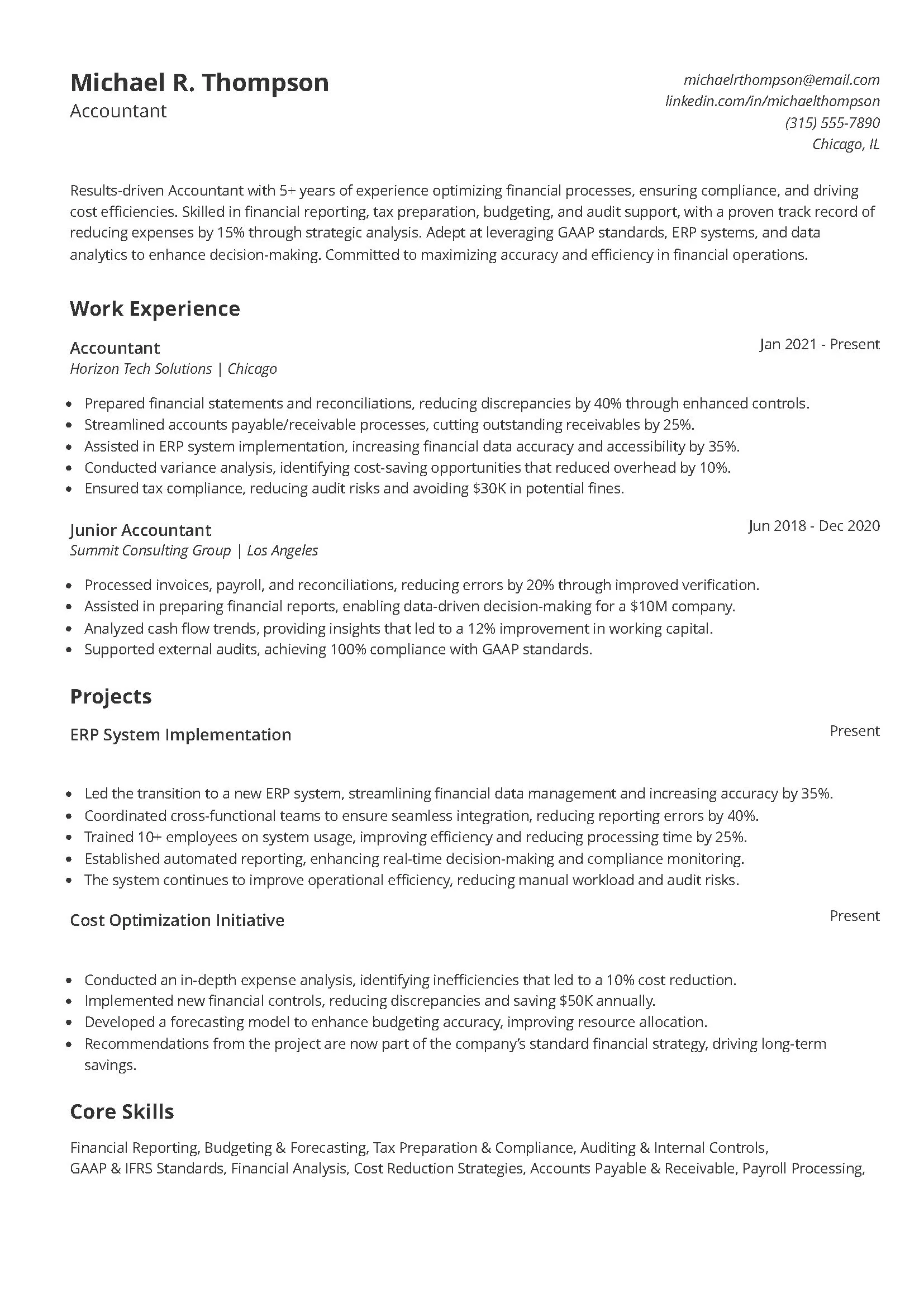

Accountant resume example

Looking for an accounting job but unsure how to make your resume stand out? Does your resume highlight your financial expertise and measurable achievements? If not, this accounting resume template is the perfect guide. It showcases a well-structured, results-driven approach that grabs attention and proves value to employers.

Accounting roles demand strong analytical skills, accuracy, and a keen understanding of financial regulations. Employers look for candidates who can manage budgets, optimize costs, and ensure compliance.

A great resume should highlight relevant experience with financial reporting, tax preparation, and process improvements to show impact and efficiency.

This resume template stands out with its clear, results-focused structure and emphasis on measurable achievements. By quantifying results like reducing discrepancies by 40% or cutting receivables by 25%, it immediately demonstrates your value as an accountant. The inclusion of key projects, such as the ERP system implementation, highlights hands-on experience and problem-solving skills. Employers appreciate this approach as it quickly showcases tangible skills and past success, making the candidate stand out as a high-impact professional.

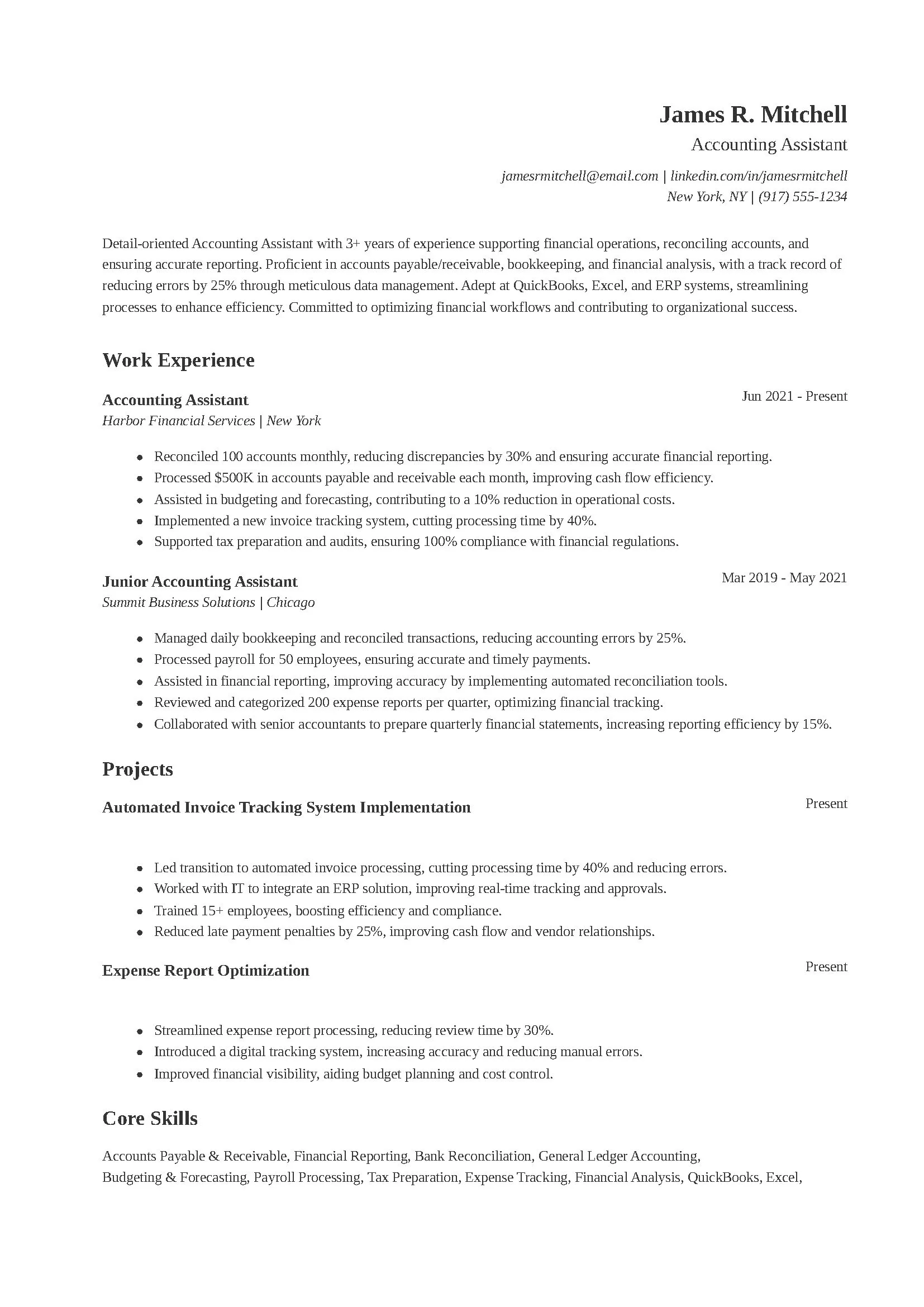

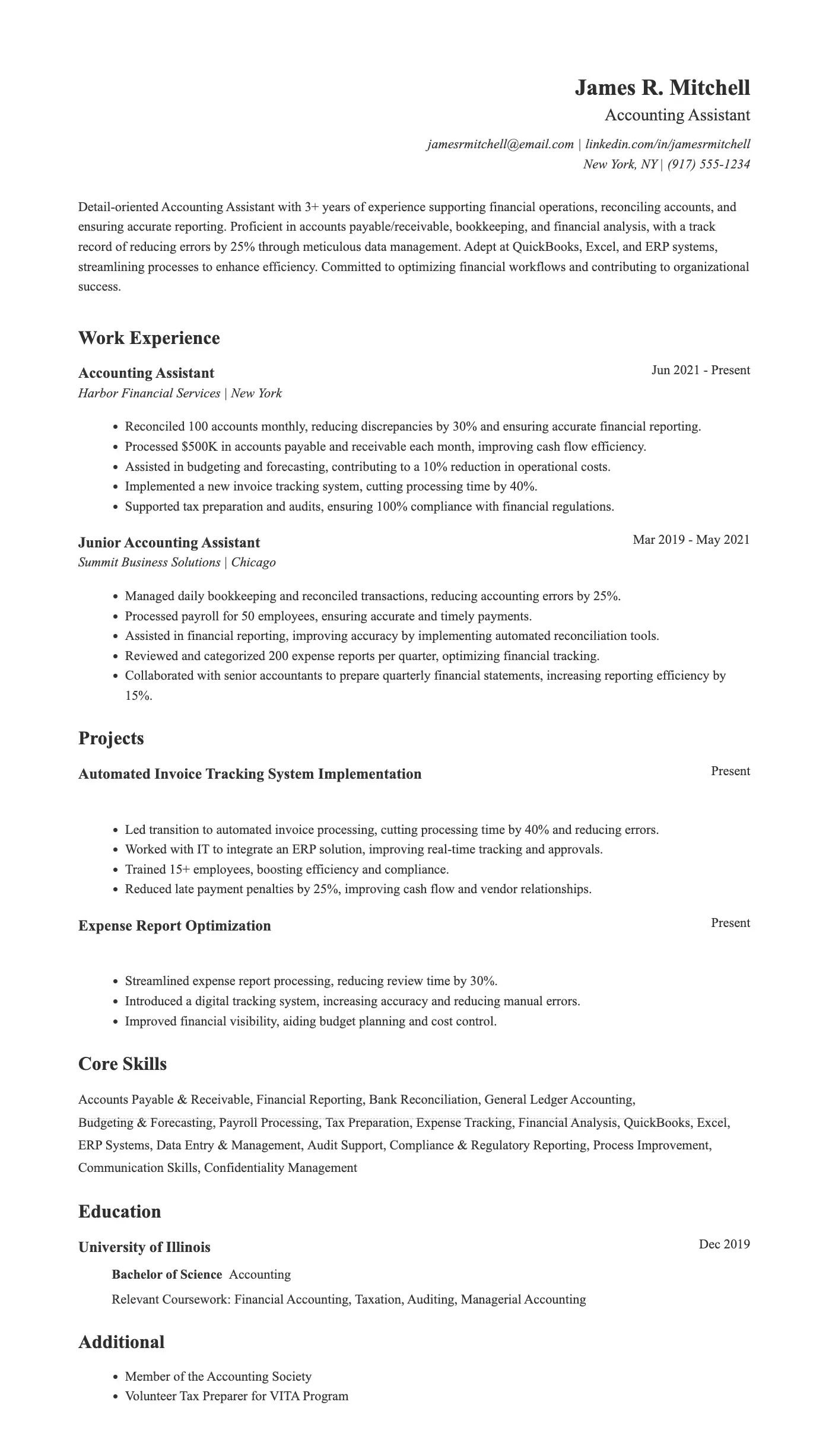

Accounting assistant resume example

Trying to land an accounting assistant job but not sure how to make your resume stand out? Wondering how to showcase your skills and experience in a way that catches an employer’s eye? This resume example highlights key achievements, relevant skills, and measurable results to help you secure your next role.

An accounting assistant plays a crucial role in keeping financial operations running smoothly. Employers look for candidates with strong attention to detail, proficiency in accounting software, and the ability to manage invoices, payroll, and reconciliations.

A great resume should highlight technical skills, problem-solving abilities, and past contributions that improved efficiency or accuracy in financial processes.

The core skills section highlights key competencies like “Accounts Payable & Receivable,” “Financial Reporting,” and “ERP Systems,” directly aligning with the responsibilities of the role of an accounting assistant. By showing practical experience and initiative like automating invoice tracking system implementation, this resume can quickly get the attention of potential employers.

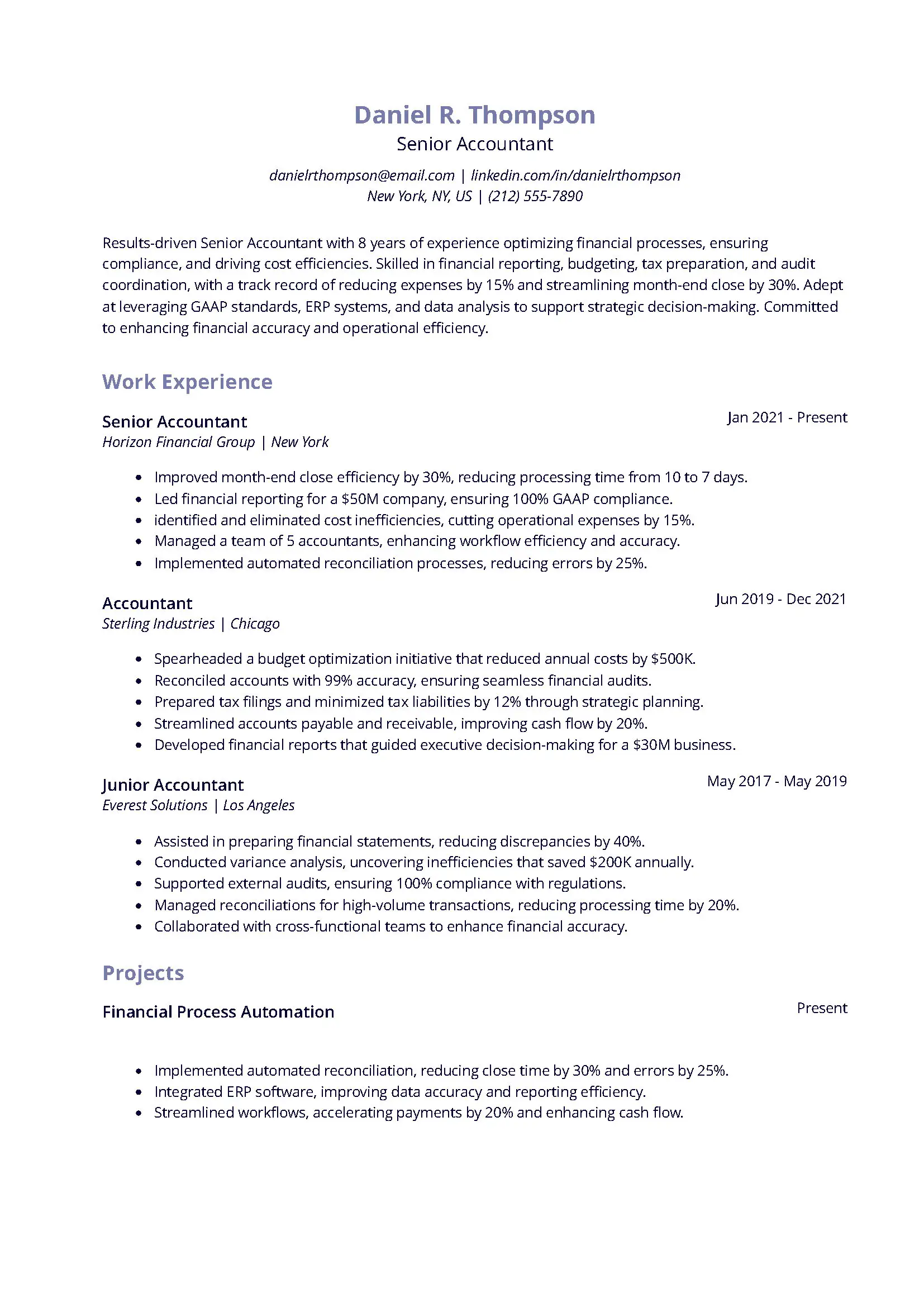

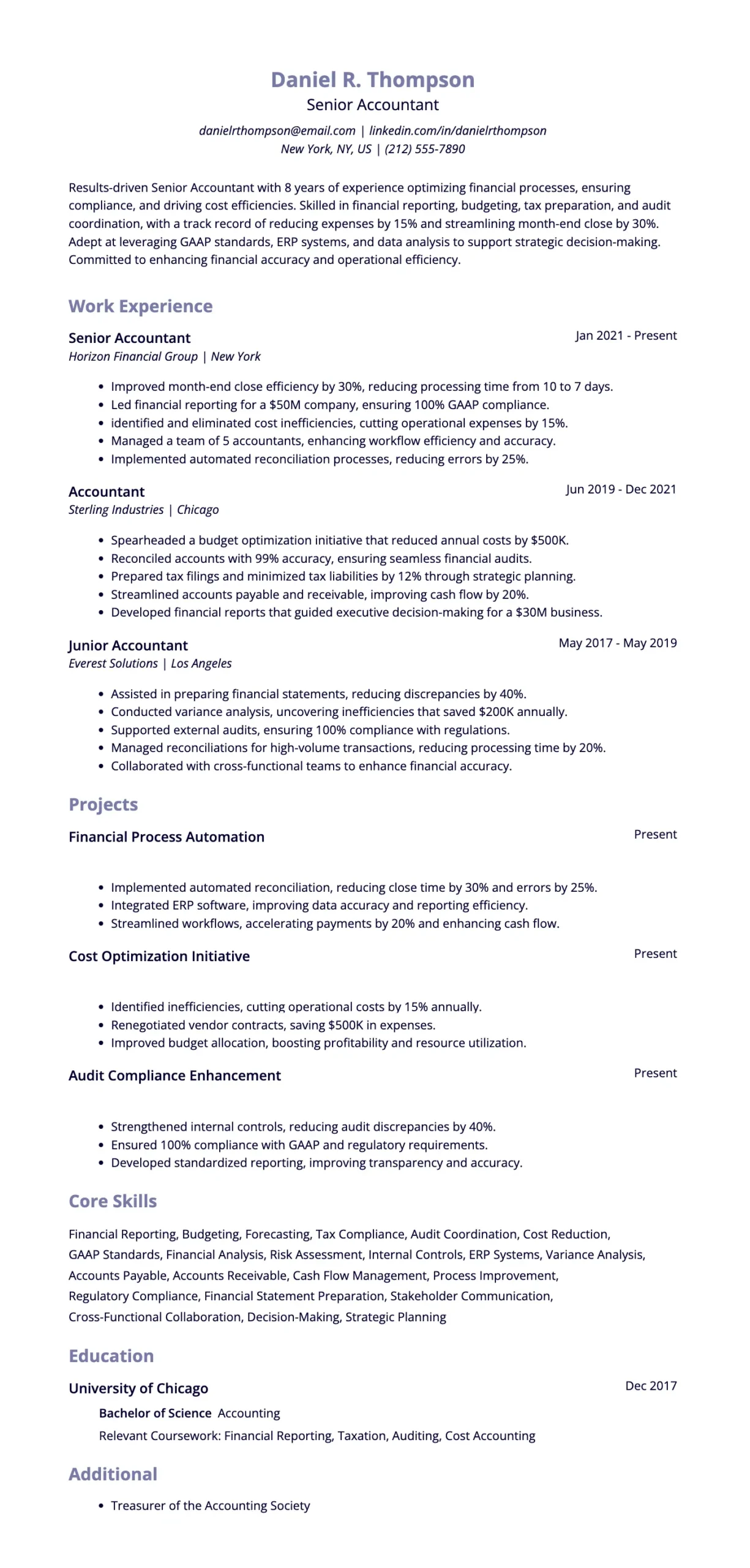

Senior accountant resume example

Looking for a strong senior accountant resume to land your next big opportunity? Not sure how to highlight your financial expertise, compliance skills, and impact on cost efficiency? This resume example showcases exactly what hiring managers want—clear accomplishments, quantifiable results, and a professional layout that stands out.

The action verbs in this resume format—such as “Improved,” “Led,” “Spearheaded,” and “Streamlined”—demonstrate a proactive, results-oriented approach. These verbs show that the candidate takes initiative and drives change. The relevant experience is also effectively highlighted, such as managing financial reporting for a large company and leading cost-saving initiatives.

This not only illustrates technical expertise but also the ability to handle significant responsibilities, which is key for attracting the attention of employers seeking experienced professionals.

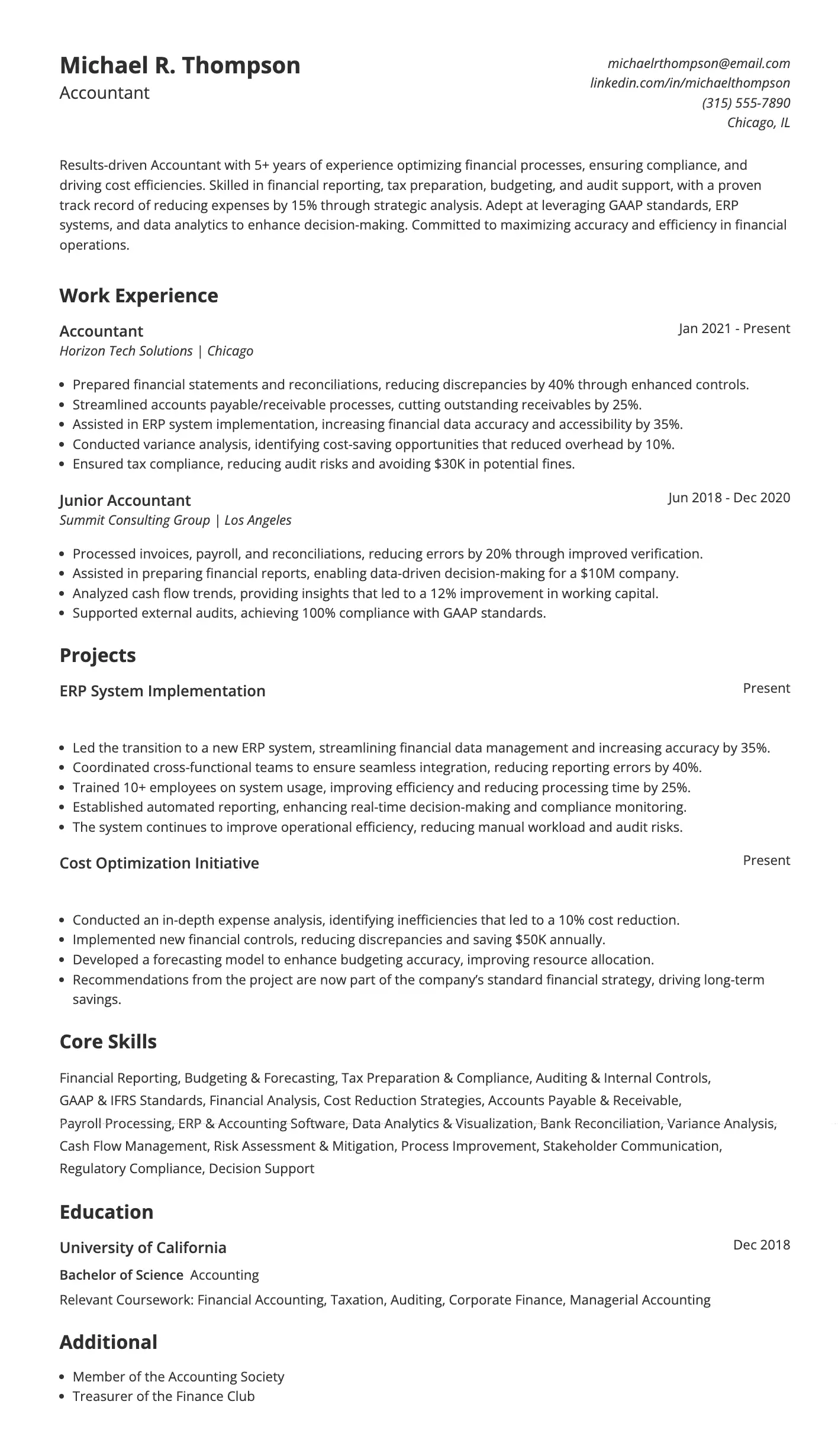

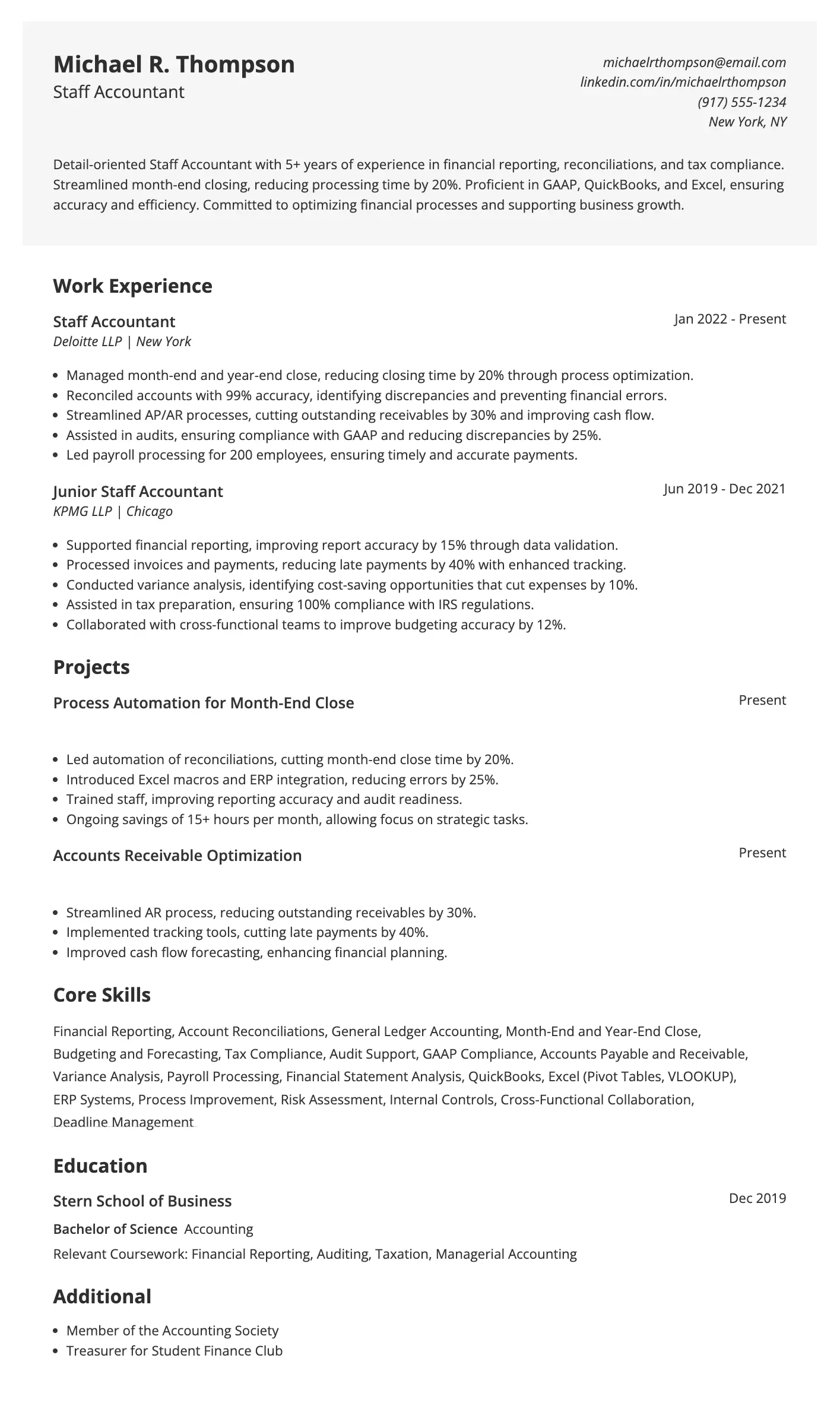

Staff accountant resume example

Need a Staff Accountant resume that grabs attention? Wondering how to showcase your skills, experience, and achievements effectively? This resume example shows exactly how to structure your work history, key accomplishments, and qualifications to impress hiring managers.

The inclusion of software skills such as QuickBooks and advanced Excel functions highlights strong technical expertise. The resume’s clean and well-organized format allows employers to easily scan and pinpoint key details. Bullet points effectively emphasize accomplishments and skills, while consistent section headings maintain clarity and structure.

This resume example not only showcases expertise but also reflects a results-driven mindset, making it highly appealing to employers who value efficiency and impact.

Also Read: 10 Best Resume Skills to Put on a Resume

This resume merges clinical nursing proficiency with data analysis capabilities, a sought-after combination in contemporary healthcare. It effectively showcases a strong foundation in clinical and analytical skills, making it ideal for entry-level nursing roles. The inclusion of key competencies like EHR proficiency, data analysis, and critical thinking highlights readiness for modern healthcare environments.

Internship and volunteer experiences demonstrate hands-on expertise, with contributions such as improving patient data retrieval by 15% and increasing clinic engagement by 30%. These experiences, paired with leadership roles, reflect adaptability and a proactive approach to patient care and healthcare innovation.

How to write an accountant resume that will get you an interview

A well-written accountant resume can make the difference between landing an interview and getting overlooked. Employers look for candidates who showcase technical expertise, analytical skills, and attention to detail.

Most companies use Applicant Tracking Systems (ATS) to simplify their hiring process. Think of ATS as a specialized search engine for resumes, where hiring managers input specific keywords to identify the best candidates. If your resume doesn’t include the right keywords, it may not be seen by a human recruiter.

For an accounting position, recruiters might search for terms like “financial reporting,” “account reconciliations,” or “tax preparation.” Including these key terms in your resume increases your chances of being noticed. Without them, your resume may be overlooked.

To optimize your resume for ATS, it’s important to understand how the system works:

- Job posting setup: Employers input job details, such as the position, required skills, and qualifications, into the ATS.

- Resume scanning: The ATS scans submitted resumes and extracts relevant information, storing it in the system.

- Searchable database: Hiring managers use specific keywords to search the database and review ranked results.

An ATS-friendly resume increases your chances of making it to the interview stage. That’s why tailoring your resume for ATS is essential for a successful job search.

Looking to create an ATS-friendly resume? Jobscan’s Free Resume Builder helps you build a resume from scratch. It organizes your resume effectively, optimizes it with the right keywords, and highlights your strengths to increase your chances of landing interviews.

Scan your resume for free

Use Jobscan's resume scanner to ensure your accounting resume is ATS-friendly and includes all the necessary keywords from the job description.

Optimize your resume

1. Key elements of an accountant resume

A strong accountant resume should include the following essential sections:

- Contact information – Your full name, phone number, email address, and LinkedIn profile (if applicable).

- Professional summary – A concise overview of your experience, skills, and career highlights.

- Work experience – A detailed list of past jobs, including your responsibilities and achievements and years of work experience.

- Education – Your degree(s) and relevant certifications.

- Skills – Technical and soft skills relevant to the accounting field.

- Certifications – CPA, CMA, or other industry-specific credentials.

2. Write a strong professional summary

Your professional summary is the first thing recruiters see, so it should quickly convey your value as a candidate. Keep it concise (3–4 sentences) and focus on your expertise, achievements, and how you can contribute to the company.

Good examples of a resume summary

- “Experienced Accountant with a track record of improving financial efficiency and accuracy. Adept at managing accounts payable/receivable, preparing financial statements, and ensuring compliance with GAAP. Proven ability to streamline accounting processes and reduce errors. CPA-certified with 8+ years of experience in corporate finance.”

- “Detail-oriented Accountant with 5+ years of experience in tax preparation and financial analysis. Skilled in utilizing accounting software like QuickBooks and SAP to optimize reporting and budgeting. Strong analytical skills with a focus on identifying cost-saving opportunities.”

Bad examples of a resume summary

- “I am an accountant with some experience in bookkeeping and taxes. Looking for a job where I can learn more about finance. Hardworking and motivated.”

- “Accounting professional who likes working with numbers. Have experience with Microsoft Excel and financial statements. Seeking an opportunity in a company that values teamwork.”

Want to write a compelling professional summary? Try Jobscan’s Resume Summary Generator—it analyzes your skills and experience, offering ATS-friendly suggestions tailored to your role. This ensures your resume is clear, impactful, and optimized with the right keywords to grab recruiters’ attention.

3. Demonstrate key accounting skills

A strong accountant resume should highlight both hard and essential soft skills. Employers look for candidates who can handle financial data efficiently while also demonstrating communication and problem-solving abilities.

Hard skills for an accountant

These are technical, job-specific abilities required for accounting roles:

- Financial Reporting and Analysis

- GAAP and IFRS Compliance

- Tax Preparation and Compliance

- Budgeting and Forecasting

- Auditing and Risk Assessment

- Accounts Payable and Receivable

- Proficiency in Accounting Software (e.g., QuickBooks, SAP, Excel)

- Payroll Processing

- Financial Reconciliations

- Cost Accounting

Soft skills for an accountant

These skills help accountants work effectively in teams and make informed financial decisions:

- Attention to Detail

- Analytical Thinking

- Problem-Solving

- Time Management

- Communication Skills

- Adaptability

- Ethical Judgment and Integrity

- Organizational Skills

- Collaboration and Teamwork

To create a strong accountant resume, it’s essential to highlight both technical expertise and soft skills in your bullet points. Rather than simply listing duties, focus on demonstrating your impact, efficiency, and measurable contributions. Here are some good and bad examples of resume bullet points.

4. Write impactful resume bullet points for accounting

Good examples of resume bullet points

- “Reduced month-end closing time by 30% by implementing automated reconciliation tools.”

- “Identified and corrected discrepancies, saving the company $50K in annual reporting errors.”

- “Led an internal audit that improved compliance with GAAP standards, preventing potential fines.”

- “Managed accounts payable for 100+ vendors, ensuring on-time payments and accurate recordkeeping.”

Bad examples of resume bullet points

- “Handled accounting tasks and reports.”

- “Worked on financial statements.”

- “Helped with audits when needed.”

- “Used QuickBooks for bookkeeping.”

Want to enhance your resume bullet points? Jobscan’s Bullet Point Generator creates strong, ATS-friendly statements that showcase your achievements and skills, helping your resume stand out.

5. Highlight your achievements as an accountant

Employers value accountants who can deliver measurable results. Instead of simply listing responsibilities, showcase your impact by using quantifiable achievements. This makes your resume more compelling and demonstrates your ability to add value.

Here are some examples of strong achievement statements:

- Implemented an automated reconciliation system, reducing financial errors by 25%.

- Identified and corrected discrepancies, saving the company $50K annually.

- Streamlined payroll processing, cutting processing time by 40%.

By emphasizing accomplishments over tasks, you make your resume more results-driven and appealing to employers.

6. Tailor your resume to the job description

Customizing your resume for each job application increases your chances of passing ATS filters and catching a recruiter’s attention. A generic resume may not highlight the exact skills and experience an employer is looking for.

How to tailor your resume effectively

- Analyze the job posting – Identify key skills, qualifications, and responsibilities mentioned.

- Use relevant keywords – Incorporate industry-specific terms and job-related phrases from the job description.

- Align your experience – Highlight achievements and responsibilities that match the job’s requirements.

- Customize your professional summary – Emphasize skills and experience most relevant to the role.

- Optimize for ATS: Use a clean layout with standard fonts and avoid excessive formatting, images, or graphics to ensure your resume is easily processed.

By tailoring your resume, you demonstrate that you’re the right fit for the position, increasing your chances of landing an interview.

Also Read: The Top 5 ATS Resume Keywords of 2025

7. Include relevant education and certifications

Your education and certifications section showcases your professionalism, qualifications and expertise in accounting. Employers value candidates with relevant degrees and industry-recognized credentials, as they demonstrate technical knowledge and commitment to professional growth.

Here’s how to highlight your education and certifications effectively for an accounting role:

- Clearly state your degree, major, and institution in a concise format (e.g., Bachelor of Science in Accounting, XYZ University).

- If you’re a recent graduate, include your graduation year along with relevant coursework or honors, such as Financial Reporting, Taxation, or Auditing.

- For experienced professionals, keep it brief and focus on higher education degrees, leaving out older or less relevant details.

- If transitioning into accounting from another field, highlight coursework or degrees that align with your new career, such as Finance, Business Administration, or Economics.

- List relevant certifications that strengthen your accounting expertise, such as CPA (Certified Public Accountant), CMA (Certified Management Accountant), or ACCA (Association of Chartered Certified Accountants).

- If you specialize in a particular area, include certifications that reflect your expertise, like Certified Tax Professional (CTP) or Certified Internal Auditor (CIA).

- For seasoned professionals, prioritize industry-recognized certifications over general training programs to showcase the most valuable credentials.

Top accountant certifications

Earning certifications can boost your resume and improve job prospects. Some of the most recognized accounting certifications include:

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Chartered Accountant (CA)

- Certified Internal Auditor (CIA)

- Enrolled Agent (EA)

- Certified Fraud Examiner (CFE)

- Advanced Excel Certification

Accountant resume tips

Creating a standout accountant resume requires more than just listing your experience. To improve your chances of landing an interview, follow these key tips:

- Keep it clear and concise: Use a clean, professional format with standard headings. Limit your resume to one page if you’re less experienced or two pages for senior roles.

- Optimize for ATS: Incorporate relevant keywords from the job description. Avoid images, tables, and complex formatting that ATS may not recognize.

- Quantify your achievements: Use numbers to highlight your impact, such as cost savings, efficiency improvements, or financial accuracy.

- Highlight key accounting skills: Balance hard skills like GAAP compliance and financial reporting with soft skills like analytical thinking and attention to detail. Mention proficiency in accounting software like QuickBooks, SAP, or Excel.

- Tailor your resume to each job: Customize your summary, experience, and skills to match the job description. Focus on relevant responsibilities and achievements for each role.

- Use strong action verbs: Start bullet points with powerful action verbs like “optimized,” “streamlined,” “analyzed,” or “implemented” to make your contributions stand out.

- Include relevant certifications: Highlight credentials like CPA, CMA, or CIA to boost credibility. If pursuing a certification, mention the expected completion date.

- Proofread for accuracy: Double-check for spelling, grammar, and formatting errors. Ensure all dates, job titles, and figures are correct.

Also Read: How to Organize Your Resume Sections to Stand Out?

Include a cover letter with your accountant resume

A well-written cover letter complements your resume by highlighting your most relevant skills and experiences while showcasing your enthusiasm for the role. It gives you the opportunity to personalize your application and make a strong first impression.

What to include in your cover letter:

- Start with a strong opening – Mention the job title and express enthusiasm for the opportunity.

- Highlight relevant skills and achievements – Focus on key accounting expertise, such as financial reporting, budgeting, or compliance.

- Showcase your value – Explain how your skills can benefit the company, using quantifiable results if possible.

- Keep it concise and professional – Stick to one page with a clear structure.

- End with a strong closing – Express interest in an interview and thank the employer for their time.

A strong cover letter can leave a lasting impression—so don’t overlook it!

Need one quickly? Use Jobscan’s Cover Letter Generator to create a job-winning cover letter in minutes!

Create a standout resume with Jobscan!

A well-written accountant resume can set you apart from the competition and increase your chances of landing an interview. By focusing on relevant skills, tailoring your resume to the job description, and highlighting key achievements, you can create a compelling application that showcases your value.

Want to make the process even easier? Jobscan’s free Resume Builder helps you create an ATS-friendly resume tailored to your desired role. With built-in keyword optimization and expert suggestions, you can ensure your resume is polished, professional, and ready to impress.

Accountant common interview questions

“Cash accounting records transactions when money changes hands, meaning revenue is recognized when received and expenses when paid. Accrual accounting, on the other hand, records transactions when they are incurred, regardless of cash flow. Most businesses follow accrual accounting as it provides a more accurate financial picture, aligning revenue and expenses with the period they occur.”

“I ensure accuracy by maintaining organized records, double-checking calculations, and using reconciliation methods to verify data. I also stay updated on accounting standards like GAAP/IFRS and leverage accounting software to minimize errors. Regular internal audits and cross-checking reports further help maintain accuracy.”

“In my previous role, I noticed a discrepancy in a financial report where expenses were overstated by $15,000. I traced the error to an incorrect entry in accounts payable, corrected it, and implemented a review process to prevent similar mistakes. As a result, we improved accuracy and reduced month-end closing errors by 20%.”

“I have experience with QuickBooks, SAP, and Microsoft Excel for financial reporting, reconciliations, and budgeting. I am also proficient in using ERP systems and adaptable to learning new software quickly, ensuring efficiency in financial management.”

Accountant resume frequently asked questions

The most important skills to include depend on the job, but key hard skills include financial reporting, GAAP compliance, tax preparation, auditing, budgeting, and proficiency in accounting software like QuickBooks or SAP. Soft skills such as attention to detail, analytical thinking, problem-solving, and time management are also essential. It’s a good idea to tailor your skills section to match the job description.

List your highest degree first, including the school name, degree obtained, and graduation year. If you have relevant certifications like CPA, CMA, or CIA, include them in a separate “Certifications” section. If you’re a recent graduate, you can also mention relevant coursework, honors, or extracurricular activities related to accounting.

If you’re new to accounting, focus on transferable skills from internships, coursework, or other jobs. Highlight relevant skills like financial analysis, bookkeeping, or data management. Use a strong professional summary, emphasize education and certifications, and include volunteer work or personal projects that demonstrate accounting knowledge. Consider adding a cover letter to further explain your passion for the field.