Best Bank Teller Resume Examples & Tips 2025

Need a standout bank teller resume? Explore expert-approved bank teller resume examples and key tips to help you impress hiring managers and secure the job.

August 4, 2025

A bank teller is crucial in ensuring smooth financial transactions and providing excellent customer service. Whether you’re an experienced teller or just starting out, having a well-structured resume is essential to stand out. This guide offers expertly designed resume examples and valuable tips to help you create a compelling, job-winning application.

Employers seek candidates with strong cash-handling skills, attention to detail, and the ability to provide top-notch customer service. A polished resume highlighting these qualities can significantly boost your chances of landing an interview.

Ready to write a resume that gets results? Keep reading to discover practical strategies, proven formatting tips, and insider insights to make your bank teller resume stand out from the rest!

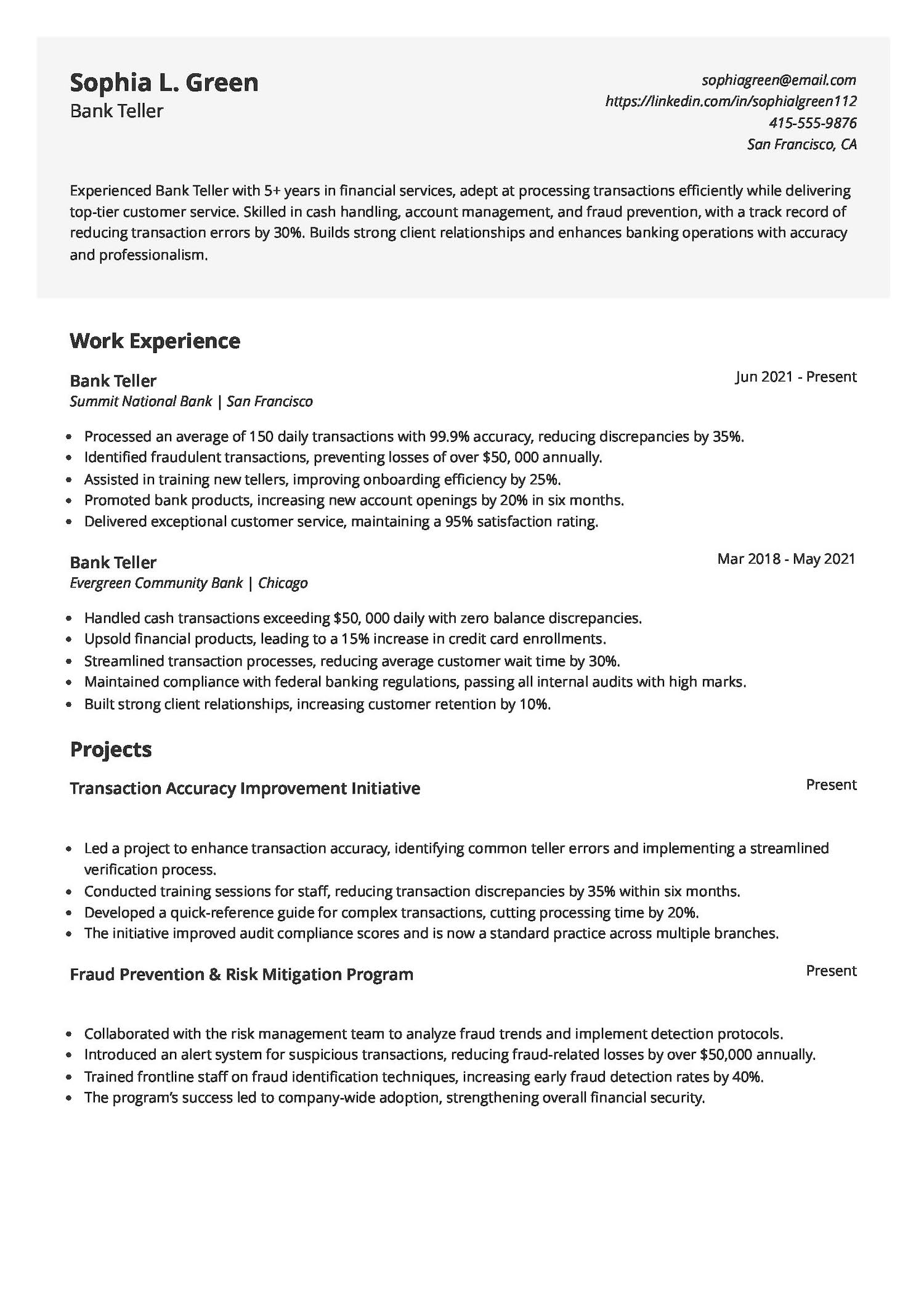

Bank teller resume example

Looking for a bank teller job but unsure how to make your resume stand out? Wondering how to highlight your cash-handling skills and customer service experience in a way that grabs attention? Check out this strong bank teller resume example—it showcases the perfect mix of accuracy, fraud prevention, and client service, all with measurable results.

Bank teller roles require more than just handling transactions. Employers want detail-oriented candidates, great with customers, and able to spot potential fraud. Strong communication, problem-solving, and knowledge of banking regulations are key. Your resume should prove you can manage accounts, upsell financial products, and keep operations running smoothly—all while providing top-tier service.

This resume opens with a clear, results-driven summary highlighting key skills like cash handling, fraud prevention, and customer service. The work experience section is packed with strong action verbs like “streamlined,” “built,” and “promoted,” and measurable achievements like “increased customer retention by 10%”, showing impact rather than just listing duties. Employers value resumes like this because they quickly prove the candidate’s efficiency, accuracy, and ability to drive results—all crucial for a bank teller role.

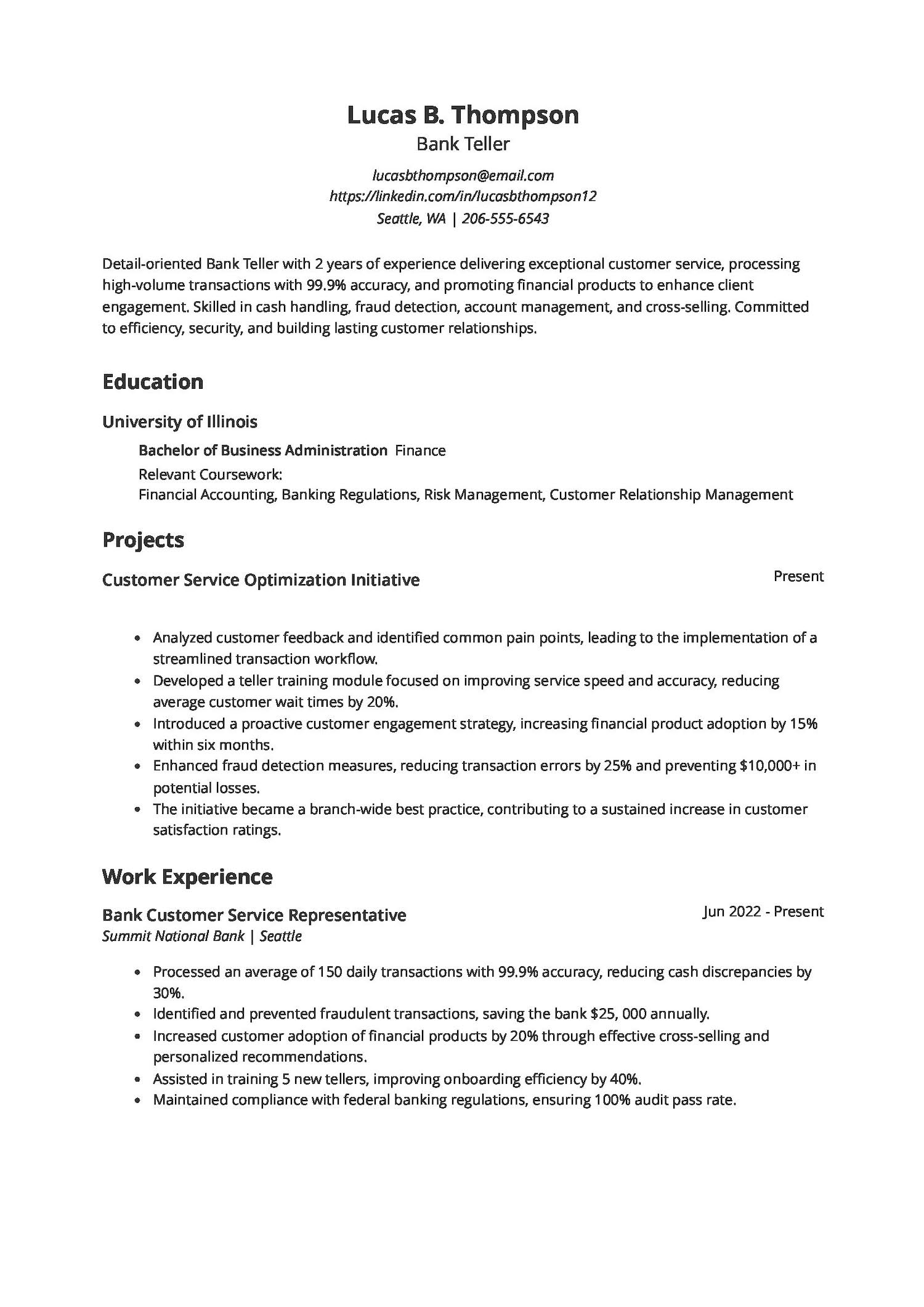

Entry-level bank teller resume example

Applying for your first bank teller job, but unsure how to create a strong resume? A great entry-level resume highlights your cash handling skills, attention to detail, and ability to provide excellent customer service, even if you don’t have direct banking experience. Need inspiration on how to write an entry-level bank teller resume? Check out the example below to see how to highlight your skills and stand out, even with little experience.

Entry-level bank teller roles require attention to detail, accuracy, and strong communication skills. Banks look for candidates who can handle cash responsibly, assist customers, and follow regulations, even without banking experience. A well-written resume should highlight transferable skills like customer service, math proficiency, and the ability to work in a fast-paced environment.

This resume template effectively shows how relevant education adds value, even with limited experience. Coursework in Banking Regulations and Risk Management highlights a strong foundation in key banking concepts, making the candidate a strong entry-level hire. It also features important skills like cash handling, fraud detection, and customer service, which are critical for a bank teller. With clear sections and concise bullet points, the candidate is presented as knowledgeable, organized, and ready to succeed in a bank teller role.

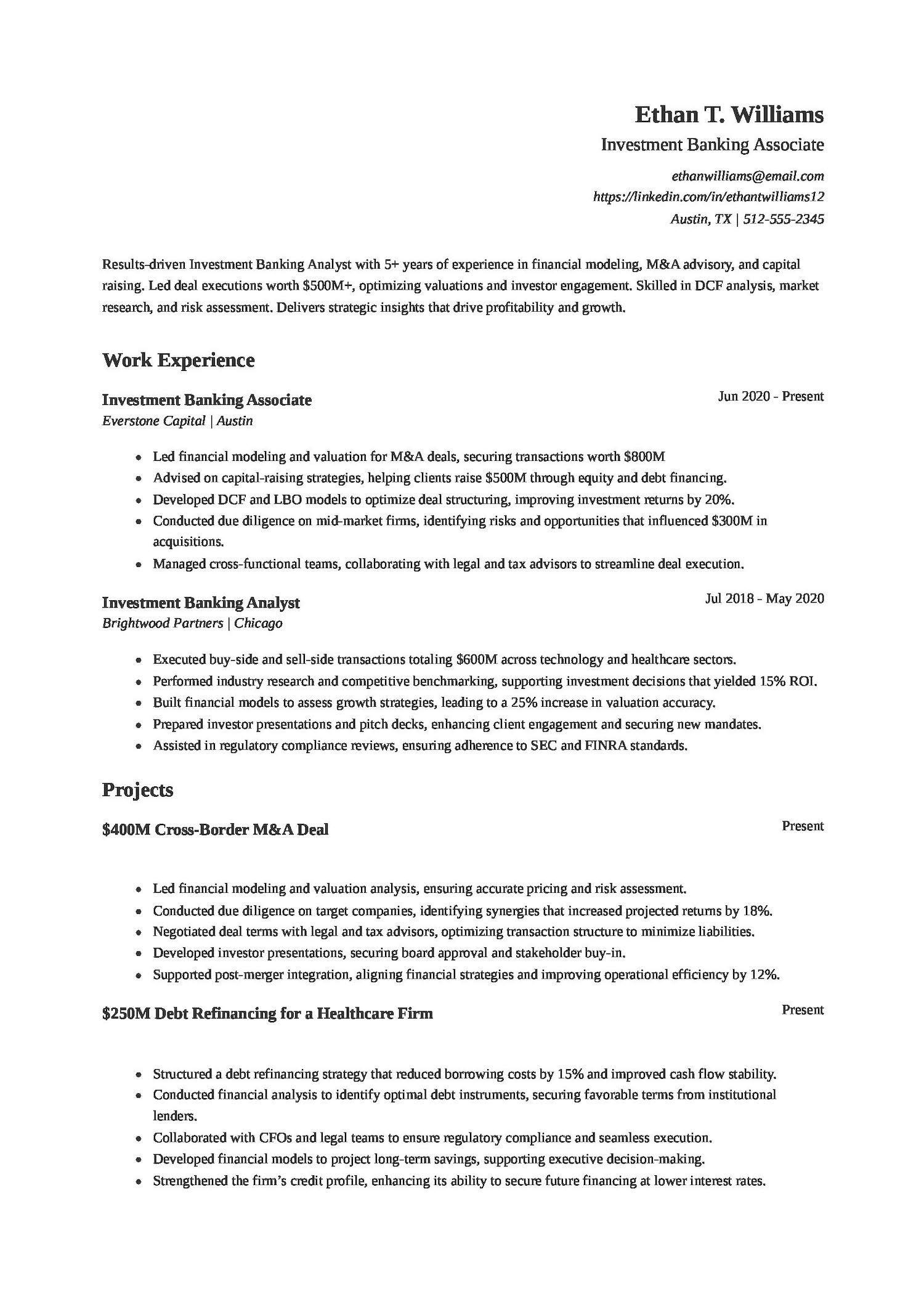

Investment banking resume example

Want to stand out in the competitive world of investment banking? Unsure how to showcase your financial expertise and transaction experience the right way? This investment banking resume example highlights the right mix of technical skills, deal execution, and measurable results to make a strong impression on employers.

Investment banking roles demand sharp financial modeling skills, market research abilities, and the ability to work under pressure. Employers look for candidates who can analyze complex data, manage transactions, and communicate insights effectively. A well-structured resume emphasizing hands-on deal experience and quantifiable success can set you apart in this competitive field.

This resume format stands out with the use of metrics like “improving investment returns by 20%,” which immediately shows measurable impact. It also uses strong action verbs like “led,” “executed,” and “built.” A dedicated Projects section further strengthens it by showcasing hands-on experience with high-value deals like “$250M debt refinancing for a healthcare firm”, highlighting valuation analysis, debt structuring, and negotiations. Hiring managers will appreciate the structured format, relevant skills, and proven results, key for thriving in fast-paced investment banking roles.

Also Read: How to Organize Your Resume Sections to Stand Out?

How to write a bank teller resume that will get you an interview

A well-written bank teller resume can set you apart from other candidates and land you an interview. To make a strong impression, your resume should highlight your customer service skills, cash-handling experience, and attention to detail.

Most banks and financial institutions use Applicant Tracking Systems (ATS) to streamline the hiring process. ATS works like a search engine for job applications—recruiters enter specific keywords related to the bank teller role, and the system scans resumes for relevant terms, formatting, and alignment with the job description. If your resume doesn’t include the right keywords or doesn’t closely match the job posting, it may never reach a hiring manager.

For example, when hiring a bank teller, recruiters may look for terms like “cash handling,” “customer transactions,” “financial services,” “fraud detection,” or “account management.” Including these keywords increases your chances of coming up in an ATS search, but omitting them could result in your application being overlooked.

How ATS works:

- Job posting setup: Employers define the job title, required skills, and qualifications.

- Resume scanning: The system analyzes submitted resumes, identifying key details.

- Searchable database: Hiring managers search for candidates using keywords or review ranked results.

Need help creating an ATS-friendly bank teller resume? Jobscan’s Free Resume Builder helps you write a well-structured resume with the right keywords, ensuring your skills and experience stand out—giving you a better chance at landing interviews.

Optimize your resume

Use Jobscan's resume scanner to ensure your bank teller resume is ATS-friendly and includes all the necessary keywords from the job description.

Scan your resume

Key elements of a bank teller resume

A strong bank teller resume should include:

- Contact information – Your name, phone number, email address, and LinkedIn profile (if applicable).

- Professional summary – A brief but impactful introduction that highlights your key qualifications.

- Work experience – Detailed descriptions of your past banking or customer service roles, focusing on achievements.

- Skills section – A list of relevant skills such as cash handling, customer service, and financial transactions.

- Education & certifications – Your highest level of education and any banking-related certifications.

Write a strong professional summary

Your professional summary is one of the first things a hiring manager will see, so it needs to be compelling. It should briefly describe your experience, skills, and what you bring to the role.

Good examples of a resume summary

- “Customer-focused bank teller with 5+ years of experience handling high-volume transactions and providing excellent customer service. Adept at balancing cash drawers, identifying discrepancies, and promoting financial products to increase revenue. Seeking to leverage strong communication and problem-solving skills at XYZ Bank.”

- “Detail-oriented and reliable bank teller with a strong track record in cash handling and fraud detection. Proven ability to maintain accuracy under pressure while assisting customers with banking transactions. Passionate about providing top-tier service and ensuring client satisfaction.”

Bad examples of a resume summary

- “I am a bank teller with some experience in handling cash and working with customers. Looking for a job where I can learn and grow.”

- “Hardworking and responsible individual seeking a bank teller position. Good at working with people and counting money.”

Struggling to create a strong professional summary? Jobscan’s Resume Summary Generator write a compelling, keyword-optimized summary in seconds, helping you stand out to recruiters. Try it now!

Demonstrate key bank teller skills

A strong bank teller resume should highlight a combination of hard skills (technical banking abilities) and soft skills(interpersonal strengths). Incorporating these into your skills section and work experience will make your resume stand out.

Hard skills for a bank teller

- Cash Handling

- Drawer Balancing

- Customer Transactions

- Fraud Detection

- Bank Software

- Account Management

- Financial Sales

- Regulatory Compliance

- Check Verification

- Currency Exchange

Soft skills for a bank teller

- Communication

- Customer Service

- Attention to Detail

- Problem-Solving

- Time Management

- Professionalism

- Teamwork

- Adaptability

Integrating both hard and soft skills into your resume bullet points can effectively showcase your capabilities and highlight your contributions as a bank teller. However, simply listing responsibilities isn’t enough—strong bullet points should demonstrate impact, efficiency, and measurable results. Let’s look at some examples of both good and bad resume bullet points to understand the difference.

Write impactful resume bullet points for a bank taller

Resume bullet points are the core of your experience section. They should clearly communicate your skills, the impact you’ve made, and the value you bring to a team. Instead of listing tasks, focus on what you accomplished using specific tools, action verbs, and measurable results. Here’s what that looks like:

Good examples of resume bullet points

- “Processed an average of 150+ customer transactions daily with 99.9% accuracy, ensuring seamless banking operations and customer satisfaction.”

- “Identified and prevented five potential fraud cases, protecting the bank from financial losses of over $10,000.”

- “Maintained 100% cash drawer accuracy for two consecutive years, demonstrating exceptional attention to detail.”

- “Increased sales of banking products by 20% by proactively educating customers on credit cards, savings accounts, and loan option

Bad examples of resume bullet points

- “Handled cash and assisted customers.”

- “Helped prevent fraud at the bank.”

- “Balanced cash drawer every day.”

- “Provided good customer service.”

Need help creating strong resume bullet points? Jobscan’s Bullet Point Generator helps you create impactful, ATS-friendly statements that emphasize your achievements. This tool ensures your bullet points are results-driven, effectively showcasing your skills and making your resume stand out.

Highlight your achievements as a bank teller

Hiring managers want to see more than just a list of job duties—they’re looking for measurable achievements that demonstrate your impact. Instead of simply stating responsibilities, highlight specific accomplishments that showcase your skills and contributions. Whenever possible, use numbers, percentages, or specific outcomes to make your accomplishments stand out.

Here are some examples of how to effectively highlight your achievements:

- “Processed an average of 150+ customer transactions daily with 99.9% accuracy, ensuring smooth banking operations.”

- “Identified and prevented potential fraud cases, saving the bank an estimated $10,000 annually.”

- “Consistently exceeded sales targets by promoting banking products, increasing branch revenue by 15%.”

- “Maintained 100% cash drawer accuracy over a one-year period, demonstrating attention to detail and reliability.”

Tailor your resume to the job description

To increase your chances of maximzing your resume’s ATS-friendliness and catching a recruiter’s attention, customize your resume for each job application. Carefully review the job description and incorporate relevant keywords and skills that match your experience.

Here’s how you can tailor your resume to the job description:

- Analyze the job posting – Carefully review the job description to identify key skills, responsibilities, and keywords used by the employer.

- Match your experience to the role – Highlight responsibilities and achievements that align with the potential employer’s needs.

- Use exact keywords from the job posting – If the description mentions “cash handling” or “customer transactions,” make sure those terms appear in your resume.

- Match your skills to the job requirements – Emphasize key competencies such as cash reconciliation, financial services, and customer service.

- Adjust your professional summary – Highlight the most relevant experience and achievements that align with the specific role.

- Refine your bullet points – If the job emphasizes fraud detection, include a quantifiable example of how you helped prevent fraudulent activity.

- Optimize for ATS – Keep your resume format clean and professional by avoiding excessive formatting, images, or unusual fonts, ensuring the ATS can parse the document.

Also Read: The Top 500 ATS Resume Keywords of 2025

Include relevant education and certifications

While a bank teller role typically does not require an advanced degree, having the right education and certifications can strengthen your resume and improve your chances of getting hired.

Here’s how to effectively highlight your education and certifications as a bank teller:

- Include your degree, major, and institution in a concise format (e.g., Associate’s Degree in Finance, XYZ College).

- If you’re a recent graduate, add your graduation year along with relevant coursework, honors, or skills related to banking, finance, or customer service.

- Experienced professionals should keep it brief, emphasizing only higher education degrees and certifications relevant to banking and financial services.

- If you’re transitioning into a bank teller role, highlight coursework or degrees that align with cash handling, customer transactions, or business operations.

- Certifications that demonstrate financial literacy, fraud prevention, or customer relationship management can strengthen your resume.

- If you have expertise in banking software or compliance, include certifications such as the ABA Bank Teller Certificate or Anti-Money Laundering (AML) Certification to showcase your qualifications.

- For those with extensive experience, it’s best to focus on industry-recognized certifications rather than listing every past training program.

Top bank teller certifications

- ABA Bank Teller Certificate

- Certified Bank Teller (CBT)

- Customer Service Certification (CSC)

- Microsoft Office Specialist (MOS)

- Anti-Money Laundering (AML) Certification

Bank teller resume tips

Creating a strong bank teller resume requires more than just listing your experience. Here are some key tips to make your resume stand out:

- Use a clear and professional format – Keep your resume well-structured with easy-to-read sections and consistent formatting. Use bullet points and avoid excessive design elements that may not be ATS-friendly.

- Tailor your resume to the job description – Highlight skills and experiences that match the specific bank teller role you’re applying for. Use keywords from the job posting to improve your chances of securing an interview.

- Start with a strong professional summary – Write a concise, compelling resume objective that showcases your experience, key skills, and customer service strengths.

- Emphasize measurable achievements – Instead of listing responsibilities, focus on accomplishments with quantifiable results (e.g., “Processed 150+ transactions daily with an accuracy rate of 99.9%”).

- Highlight key banking and customer service skills – Include a mix of hard and soft skills such as cash handling, fraud detection, customer service, and attention to detail.

- Use strong action verbs – Start bullet points with impactful verbs like “processed,” “managed,” “identified,” or “resolved” to make your experience more dynamic and engaging. Avoid passive language or generic phrases like “responsible for.”

- Incorporate relevant certifications – Certifications can contribute to professional development, and adding certifications like the ABA Bank Teller Certificate or Anti-Money Laundering (AML) Certification can add credibility to your resume.

- Keep it concise – Limit your resume to one page if you have less experience or two pages if necessary. Focus on the most relevant details.

- Proofread carefully – Ensure your resume is free of typos and grammatical errors, as accuracy is crucial in banking roles.

Also Read: How to Organize Your Resume Sections to Stand Out?

Include a cover letter with your bank teller resume

A well-written cover letter can strengthen your job application by showcasing your enthusiasm for the role and highlighting key qualifications. While your resume highlights your key qualifications, a cover letter is a great way to personalize your application and show why you’re the perfect fit for the position.

What to include in your cover letter:

- Start with a strong introduction – Mention the position you’re applying for and briefly explain why you’re interested in the role and the bank.

- Highlight relevant skills and experience – Emphasize specific skills like customer service, cash management, risk management, banking-related skills, and even language skills, if applicable, linking them to the specific job requirements.

- Show enthusiasm for the role – Demonstrate your passion for helping customers and contributing to a positive banking experience.

- Keep it concise – A cover letter should be no longer than one page, with three to four short paragraphs.

- End with a strong closing – Express your interest in discussing the role further and include a polite call to action, such as requesting an interview.

Have trouble writing the perfect cover letter? Jobscan’s AI-powered Cover Letter Generator helps you create personalized, ATS-friendly cover letters in seconds, saving you time and increasing your chances of landing interviews.

Create a standout bank teller resume with Jobscan

A well-structured bank teller resume can make a significant impact in securing your ideal job. By emphasizing key skills, aligning your resume with the job description, and showcasing measurable achievements, you can stand out in a competitive hiring process. Pairing your resume with a strong cover letter further enhances your chances of making a great first impression.

Need help writing a professional, ATS-friendly resume? Try Jobscan’s free Resume Builder to generate a customized resume in minutes. Simply enter your details, and the tool will format your resume to meet industry standards, helping you get noticed by hiring managers faster.

Bank teller common interview questions

How would you handle a difficult customer?

Answer:

“In my previous role as a new teller, I would remain calm, listen carefully to the customer’s concerns, and show empathy. If the issue involves a banking transaction, I would explain the policy clearly and offer a solution within my authority. If necessary, I would escalate the situation to a manager while ensuring the customer feels heard and valued. My goal is to provide excellent service and reduce customer complaints while maintaining professionalism and following bank policies.”

How do you ensure accuracy when handling cash transactions?

Answer:

“Accuracy is critical in banking, and I follow a strict process to minimize errors. I carefully count cash before and after transactions, use bank-provided counting tools, and double-check amounts before finalizing any deposit or withdrawal. Staying focused, minimizing distractions, and following established procedures help me maintain accuracy and prevent discrepancies.”

What would you do if you suspected fraudulent activity?

Answer:

“If I suspected fraud, I would follow the bank’s procedures for handling suspicious activity. I would remain professional and discreet while gathering necessary details, then report my concerns to the appropriate supervisor or fraud prevention team members. I understand the importance of protecting customers and the bank from financial risks while maintaining compliance with regulations like AML and KYC policies.”

Why do you want to work as a bank teller?

Answer:

“I enjoy working in customer service and have a strong attention to detail, which makes me well-suited for a bank teller role. I find it rewarding to assist customers with their financial needs and provide solutions that improve their banking experience. Additionally, I am interested in the financial industry and see this position as a great opportunity to develop my skills and grow within the banking sector.”

Bank teller resume frequently asked questions

What are the most important bank teller skills to highlight on a resume?

A strong bank teller resume must have a list of skills that include both hard and soft skills. Key hard skills include cash handling, financial management, drawer balancing, customer transactions, teller operations, fraud detection, and knowledge of banking software. Soft skills such as leadership skills, customer service excellence, communication, attention to detail, and problem-solving are equally important. Tailoring your skills to match the job description can help your resume stand out.

How do I include my education experience in a bank teller resume?

List your education in a dedicated Education section, including your degree, major, and institution (e.g., “Associate’s Degree in Finance, XYZ College”). If you’re a recent graduate, you can include relevant coursework or honors related to finance, banking, or customer service. You can also mention relevant workshops attended, like financial literacy workshops. If you have certifications, such as the ABA Bank Teller Certificate or Anti-Money Laundering (AML) Certification, list them in a separate Certifications section.

How should I write a resume if I have no experience as a bank teller?

If you lack direct experience, focus on transferable skills from previous roles in customer service, retail, or administrative positions. Highlight relevant experience or volunteer work, such as handling cash, assisting customers, or managing transactions. Use a strong professional summary to showcase your strengths as a junior teller, and emphasize soft skills like communication and problem-solving. Including certifications or relevant coursework can also help demonstrate your qualifications.